[Credits to DAX ]

High Probability Setup Dashboard

Setup Breakdown

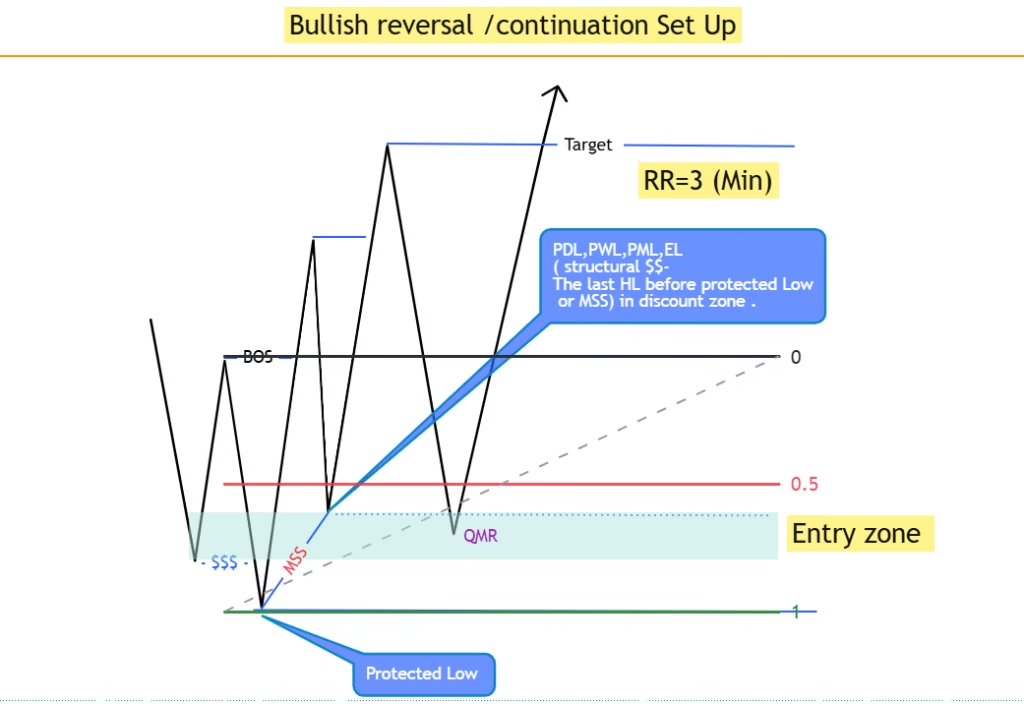

Step 1: Price performs a liquidity sweep of previous lows (e.g. daily, weekly, monthly, equal lows).

Step 2: Price expands higher, causing a Break of Structure (BoS), retraces, and forms a Higher Low (HL) without taking out the swept low.

Step 3: After another BoS, price returns to take out the structural liquidity under the HL, then reverses for a longer move upward.

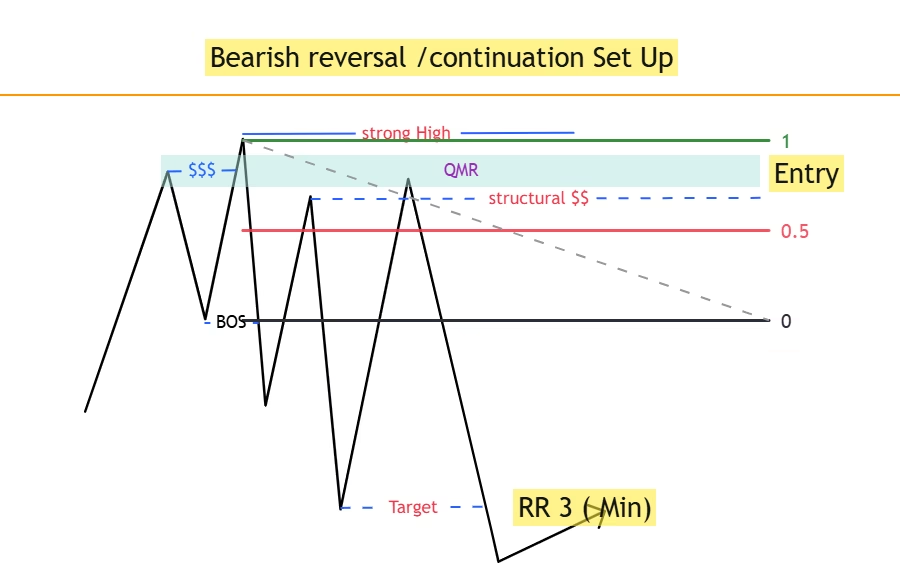

This setup confirms a trend reversal or continuation and sets the stage for a bullish swing entry. Flip this logic for bearish trades.

High Probability Instruments (Forex, Indices, Commodities, Crypto)

| Checklist Point | Reversal Bias | Continuation Bias |

|---|---|---|

| Is there unmitigated demand/supply below/above? | ❌ No zone left | ✅ Zone exists below sweep |

| Was sweep followed by strong BOS in new direction? | ✅ Yes | ❌ No BOS or weak BOS |

| Did sweep create FVG + OB + displacement? | ✅ Yes | ❌ No imbalance or poor reaction |

| Is sweep aligned with HTF trend change or discount/premium zone? | ✅ Yes (HTF flip/OB) | ❌ Sweep in middle of structure |

| Volume/Order Flow shows absorption/rejection at sweep? | ✅ Yes | ❌ No OF confirmation (aggressive sellers winning) |

| Multiple rejections from same area post-sweep? | ✅ Indicates defense | ❌ Price slices through like butter |

🧠 What to Avoid ❌❌

🚫 Entering without BOS after sweep

🚫 Trading in the middle of the range

🚫 Ignoring unmitigated HTF zones below/above

🚫 Placing SL inside OB (too tight)

🚫 Entering in premium when bullish (or discount when bearish)