The patterns ( Set-Up) on 1H-4h

Set Up Analysis,Validation & Execution

- Where does the price come from? (Market structure<range or trend>), HTF POI?

- What is the dealing range or Swing Structure?

- What is the price reacting to? ( a MSS on HTF, OB, FVG, HVN, Supply and Demand from Premium into Discount buy set up or from discount into premium sell set up ?? etc..

- Is pattern in premium or discount 1h and 4h and 1D?

- Flow in the directon of the trend ( not mandatory )

- Ensure there is no unmitigated demand or supply close to the POI

- Sentimental & Fundamental analysis Bias ( EdgeFinder or ChatGPT)

- Market Profile and Volume Profile Confluence for POI

- Validate SLQ ( 50%, Valid A,V shaped,3 candles Min)

- TP at 2RR

- Risk 1%

- Avoid news !

ORDERFLOW TRADING ( CRYPTO, FUTURES, GOLD)

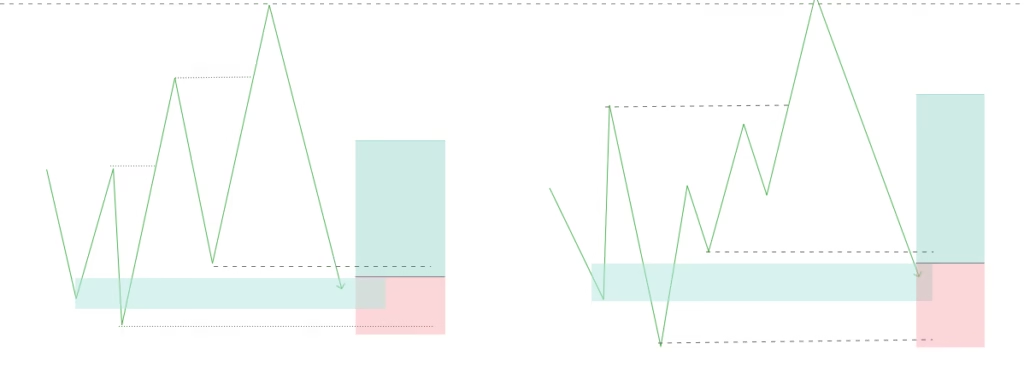

🔎 Mean Reversion Model

- Short Setup: Price trades above previous day’s VAH → forms a sell tail rejection → you confirm with major liquidations (Rektv) → you short.

- Long Setup: Price trades below previous day’s VAL → forms a buy tail rejection → confirm with major liquidations → you long.

- Best environment: Ranging market → mean reversion to inside value area.

- Edge: High risk-to-reward since you’re entering after liquidity sweep + rejection, targeting mid/POC.

⚠️ The Weak Spot (Where You Can Get Trapped)

- Strong Trend Days:

- If BTC is trending (high OI expansion + strong CVD with price), those VAH/VAL tails can fail → price keeps pushing → your fade trade gets steamrolled.

- Example: CPI release, FOMC, ETF news → liquidation cascade doesn’t bounce back, it accelerates trend.

- Thin Liquidity Hours:

- If you fade during Asia low-liquidity, tails don’t always mean reversal, just chop.

🛡 How to Make It Safer

Here’s how to filter so you only take “high probability fades”:

- Check OI Behavior

- If OI spikes with liquidation wick → real trap → fade works.

- If OI decreases → liquidation flush complete → likely reversal.

- If OI keeps climbing with price → strong trend → don’t fade.

- Check CVD

- In a fade setup, you want CVD to fail to confirm price extremes.

- Example: Price breaks above VAH, but CVD doesn’t make new high → good short.

- Session Context

- Fades work best in ranging sessions (Asia / early London).

- Breakouts/trends dominate in NY session with news flow.

- Target Management

- Don’t always aim for full POC return. Sometimes price only retests VAH/VAL and rejects again.

- Partial TP at mid-value keeps equity curve smoother.

Reading the Initial Balance (IB)

The Initial Balance (IB) = the range of the first 1 hour of the session (often London or NY depending on your focus).

How it guides the day type:

📌 Balanced Day (good for fades)

- Price trades mostly inside IB.

- Both IB high/low respected multiple times.

- OI is steady, not expanding aggressively.

- CVD swings both ways (no one-sided pressure).

👉 Your fade setups (tails at VAH/VAL with liquidation) have highest probability here.

📌 Trend Day (danger for fades)

- Price extends IB early and holds outside.

- OI expands consistently in direction of breakout.

- CVD keeps trending with price (no divergence).

- Pullbacks shallow, buyers/sellers absorbed quickly.

👉 Here, fading is dangerous. Better to switch to breakout continuation strategy.

📌 Neutral Day (fade early, watch later)

- Price first breaks IB one side, then rotates across to the other side.

- Often driven by news.

- OI choppy, CVD also whipsaws.

👉 Fades may work early, but after second IB break, expect volatility.

⚙️ How You Combine It

- Balanced IB day = go hunt your tails + liquidation fades at VAH/VAL.

- Trend IB day = don’t fade, shift mindset to scalping pullbacks in direction of trend.

- Neutral IB = take early fade, but watch for full rotation.

📘 BTC Orderflow Scalping Playbook

Setup 1: Fade-Tail Model (Balanced Day)

Objective: Fade trapped traders at extremes (VAH/VAL).

Best Market Type: Balanced / rotational days.

Checklist:

- Price trades outside yesterday’s VAH/VAL.

- A liquidation cluster (Rektv) fires at the extreme.

- Price shows tail rejection (footprint absorption, low follow-through).

- OI behavior:

- Drops = forced liquidation, trap → ✅ good fade.

- Rises = aggressive new positioning → ⚠️ danger of trend day.

- CVD behavior:

- Price new high/low but CVD divergence = ✅ good fade.

- CVD trending with price = ⚠️ no fade.

Execution:

- Enter at/just inside tail after liquidation cluster.

- Stop: just beyond tail (low risk).

- TP1: Mid value.

- TP2: POC.

- Trail remainder if price stalls at POC.

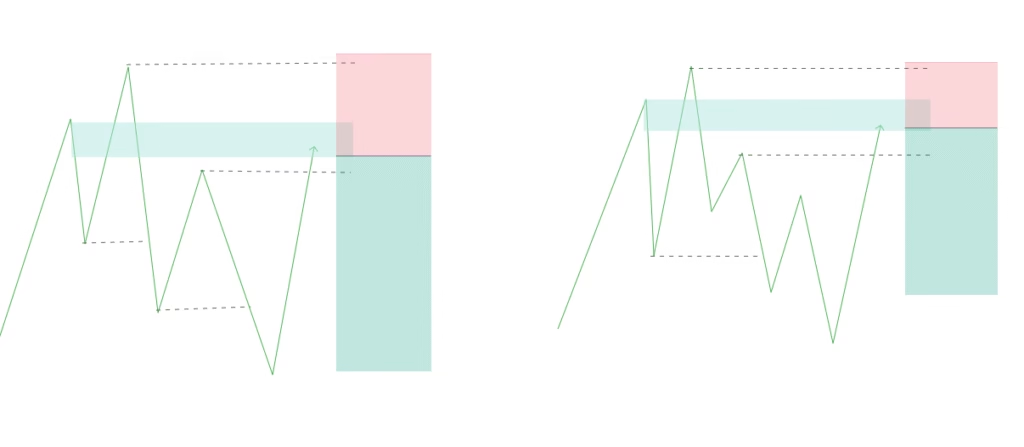

Setup 2: Trend-Continuation Model (Trend Day)

Objective: Join momentum early and scalp pullbacks in the direction of imbalance.

Best Market Type: Trend days (news-driven, IB breakout holds).

Checklist:

- IB Breakout: Price extends beyond IB high/low in first 2–3 hours.

- OI behavior: Expanding consistently with price = strong conviction.

- CVD: Trending in breakout direction, no major divergences.

- Liquidity Check: Rektv shows shorts/longs liquidated into breakout, but price holds and accepts outside range.

- Footprint confirmation: Absorption on pullbacks (e.g., big sell delta absorbed in uptrend, no downside continuation).

Execution:

- Entry 1: After IB breakout retest (acceptance).

- Entry 2: On pullback to micro-POC / single print imbalance inside trend.

- Stop: just inside prior balance/IB.

- TP1: 1–2x risk.

- TP2: Next liquidity cluster / range extension (measured move).

- Trail if OI still expands with move.

🧭 How to Know Which Setup to Use

This is the decision filter:

- Check Initial Balance (IB):

- Price stays inside IB = likely Balanced → use Fade-Tail model.

- Price extends IB and holds = likely Trend → use Trend-Continuation model.

- Confirm with OI + CVD:

- OI rising + CVD aligned = Trend → Setup 2.

- OI dropping/flat + CVD divergence = Balance → Setup 1.

📘 BTC Daily Trading Plan (Orderflow, Exocharts)

1️⃣ Pre-Market Prep (Before 4am IB Lock)

- Mark yesterday’s VAH, VAL, POC (from daily profile).

- Mark today’s developing IB high & low (first hour of trading).

- Note key news events (macro, Fed, BTC ETF, etc.).

👉 These give you your “map” for the day.

2️⃣ Classify Day Type (After 4am, once IB is set)

Step 1: Where is price relative to yesterday’s value?

- Inside → possible balanced day.

- Above VAH or below VAL → possible trend day.

Step 2: What does IB show?

- Price rotating inside IB → Balanced.

- Price breaks IB and accepts outside → Trend.

Step 3: Confirm with Orderflow (Exocharts)

- OI expanding + CVD aligned with price → Trend Day.

- OI flat or dropping + CVD divergences → Balanced Day.

3️⃣ Trading Rules by Day Type

A. Balanced Day (Mean Reversion Focus)

🎯 Main Weapon: Fade-Tail Model

Entry Rules:

- Wait for price to tag yesterday’s VAH/VAL OR today’s intraday VAH/VAL.

- Watch for sell/buy tail rejection on footprint.

- Confirm with:

- 🔻 OI dropping (forced liquidation, not new trend).

- 🔄 CVD divergence (price makes new extreme, CVD fails).

- 💥 Rektv cluster fired at extreme.

Execution:

- Enter fade trade.

- Stop = just beyond tail (tight risk).

- TP1 = back to mid/IB.

- TP2 = POC of yesterday/today.

- If price stalls, exit remainder at POC.

Rule: Prioritize yesterday’s VAH/VAL over intraday levels (Tier 1 > Tier 2).

B. Trend Day (Momentum Focus)

🎯 Main Weapon: Trend-Continuation Model

Entry Rules:

- IB breakout + acceptance outside yesterday’s VAH/VAL.

- OI expanding + CVD trending in breakout direction.

- Rektv shows liquidation against breakout side (trapped traders).

Execution:

- Entry 1: On IB breakout retest.

- Entry 2: On pullback to micro POC or imbalance left by breakout.

- Stop = just inside IB or prior balance.

- TP1 = 1–2x risk.

- TP2 = next daily/weekly liquidity pool (or 1.5x IB range extension).

- Trail final portion with delta/OI momentum.

Rule: No fading tails on confirmed trend days.

4️⃣ Intraday Management

- Re-assess after each major session open:

- London → confirm balance or trend.

- NY → watch for second breakout or continuation.

- If you’ve already hit 2R profit → reduce risk size for next trades.

- If you hit max daily stop (e.g., 2 losses) → stop trading.

5️⃣ Daily Workflow (Quick Checklist)

- Mark levels (yesterday’s VAH/VAL/POC, today’s IB).

- Classify day type (Balance vs Trend) using IB + OI + CVD.

- Choose weapon:

- Balance → Fade tails with liquidations.

- Trend → Join breakout continuation.

- Confirm entry with orderflow (OI, CVD, Rektv, footprint).

- Execute & manage risk:

- Tight stop at tails/IB.

- Scale at POC or extension levels.

- Trail only with strong OI/CVD momentum.

- Review EOD: Save screenshots of trades, note day type, what worked/failed.

✅ With this, you’ll have a repeatable routine:

- Start at 4am → mark levels, classify day, pick strategy.

- Trade only high-probability fades on balance days or continuations on trend days.

- Avoid overtrading intraday tails unless all confirmations align.