1️⃣ Weekly Bias ( Trend Continuation)

- HTF Structure: BULLISH

- Mommentum: BULLISH

- Market phase: Consolidation

- Trade location (premium)

📊 Chart screenshots/ Analysis /Outcome

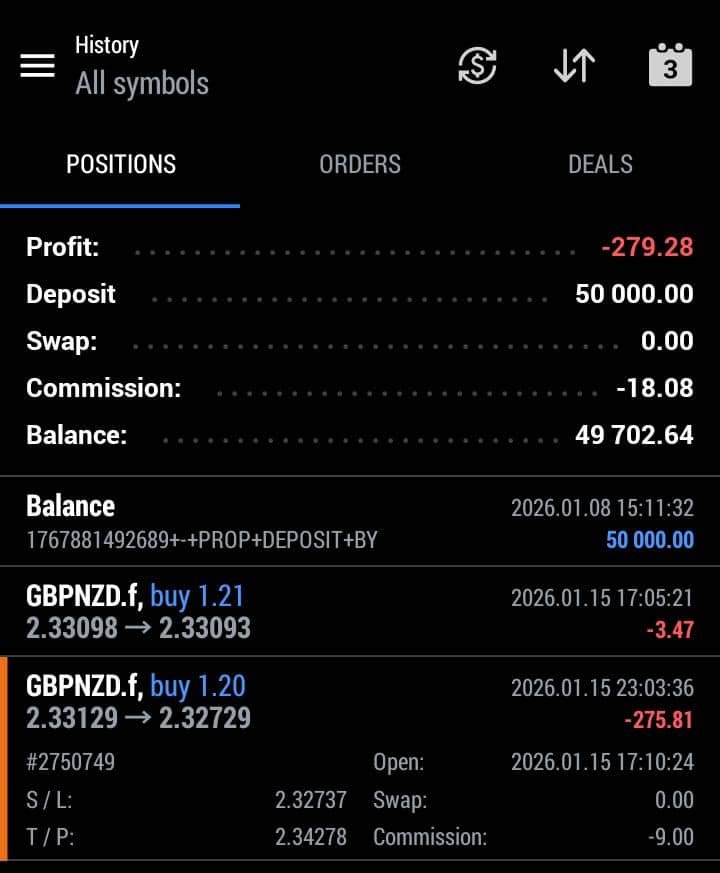

2️⃣ Trade Breakdown

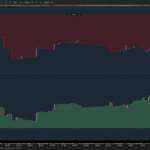

- Instrument: GBPNZD

- Date Entry: 16-01-2026

- Trade duration: 06hrs

- Bias -Bullish

- Entry model ( LIMIT)

- Act Sze= 50k ( Phase 1)

- Risk (%) =0.5

- RR achieved=-1R

- Outcome (Loss)

3️⃣ Execution Review

- AUDJPY and GBPNZD correlation raised some doubts, but I trusted the structure and Independent OF.

- Entry and SL discrepancies between WSWS( My prop broker ), FXCM, and Ohanda ( which I use for analysis)

- 00H00 spread took me out even before the trade hit SL.

- Emotional state (robotic execution )

📊 Chart screenshots/ Execution

4️⃣ Lessons of trade

- Consider the above-mentioned issues when placing trades ( time, price, spread, etc). Trade management is as important as the analysis

- I was not strict with my rules.

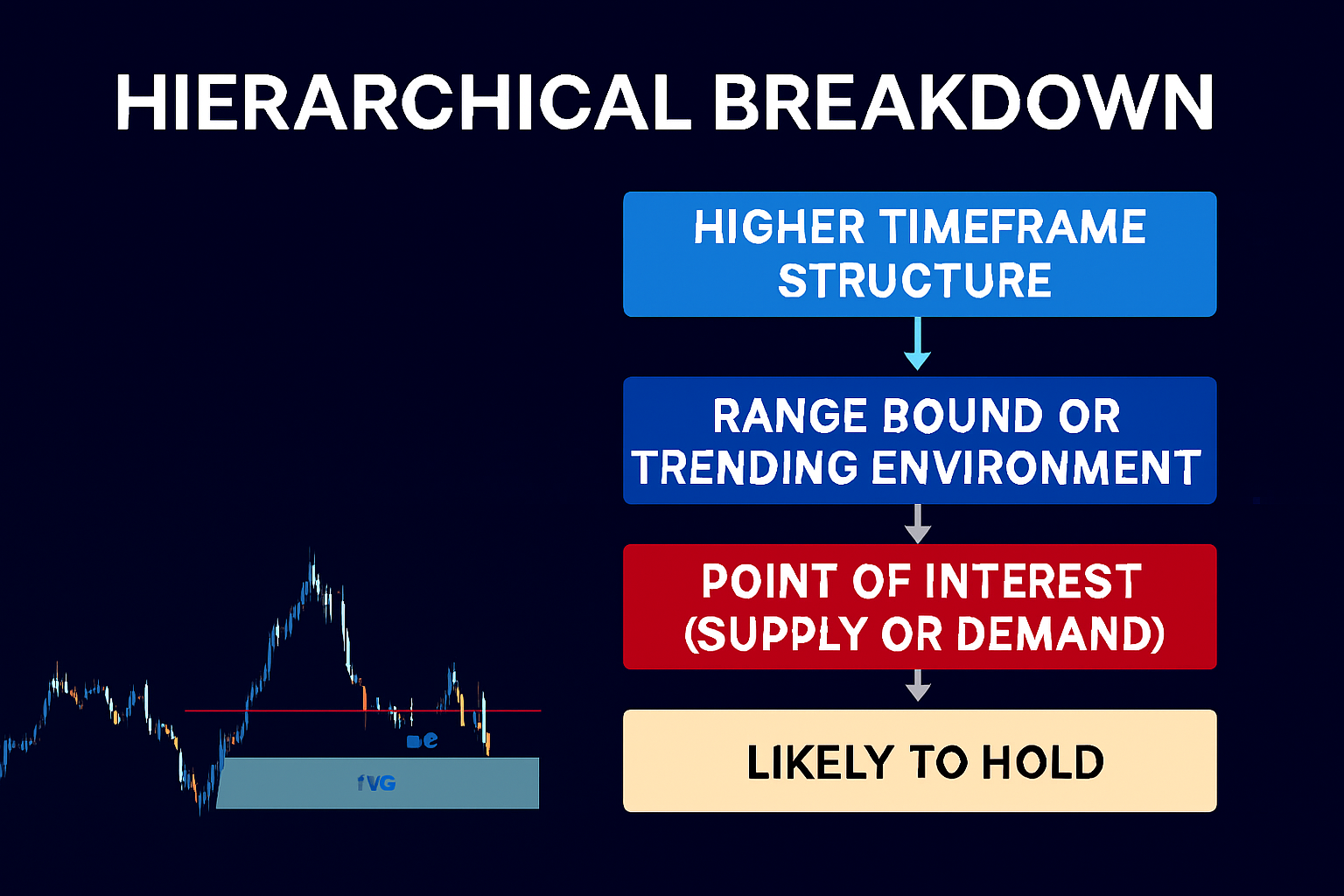

- Looking at close details, this setup was not a valid one; Sweep✔️, Break✔️, SLQ❌, POI❌.( No QMR, OB mitigated )

- The market phase was consolidation, meaning the trade location becomes very important, even if momentum is still bullish on the HTF.P (Sells )/D(buys).

- Hence, price haven encounted resistance or tapped into Supply will go straight into demand ( deep discount ).

- This was a complete lack of discipline issue ( A forced trade ).

WE MOVE ….