The GamePlan.

Introduction

Who am I? My name is Namekong Luther, and I started trading in 2025 from BabyPips.

This journal aims to prove that you don’t need to spend years before becoming profitable.

“This journal exists to document process, discipline, and execution—not to guarantee returns.”

ALGO SWING TRADING PLAN PRO [DAX]

INSTRUMENTS

AUD/CAD, AUD/CHF, AUD/JPY, AUD/NZD, AUD/USD, CAD/CHF, CAD/JPY, EUR/AUD, EUR/CAD, EUR/CHF, EUR/GBP, EUR/JPY, EUR/NZD, GBP/AUD, GBP/CAD, GBP/CHF, GBP/JPY, GBP/NZD, NZD/CAD

NZD/CHF, NZD/JPY, NZD/USD, USD/CAD, USD/CHF, USD/JPY, BTC/USD, S&P500, NAS100

US30 Tip (consider the spreads).

TRADE ENTRY: (1H OR 4H) TF

MAIN SETUPS: One of these setups MUST be present:

- Bullish Algo MS, Type 1 or 2 . (Sweep, SLQ, BoS, POI valid)

- Bearish Algo MS, Type 1 or 2 . (Sweep, SLQ, BoS, POI valid)

CONFIRMATION

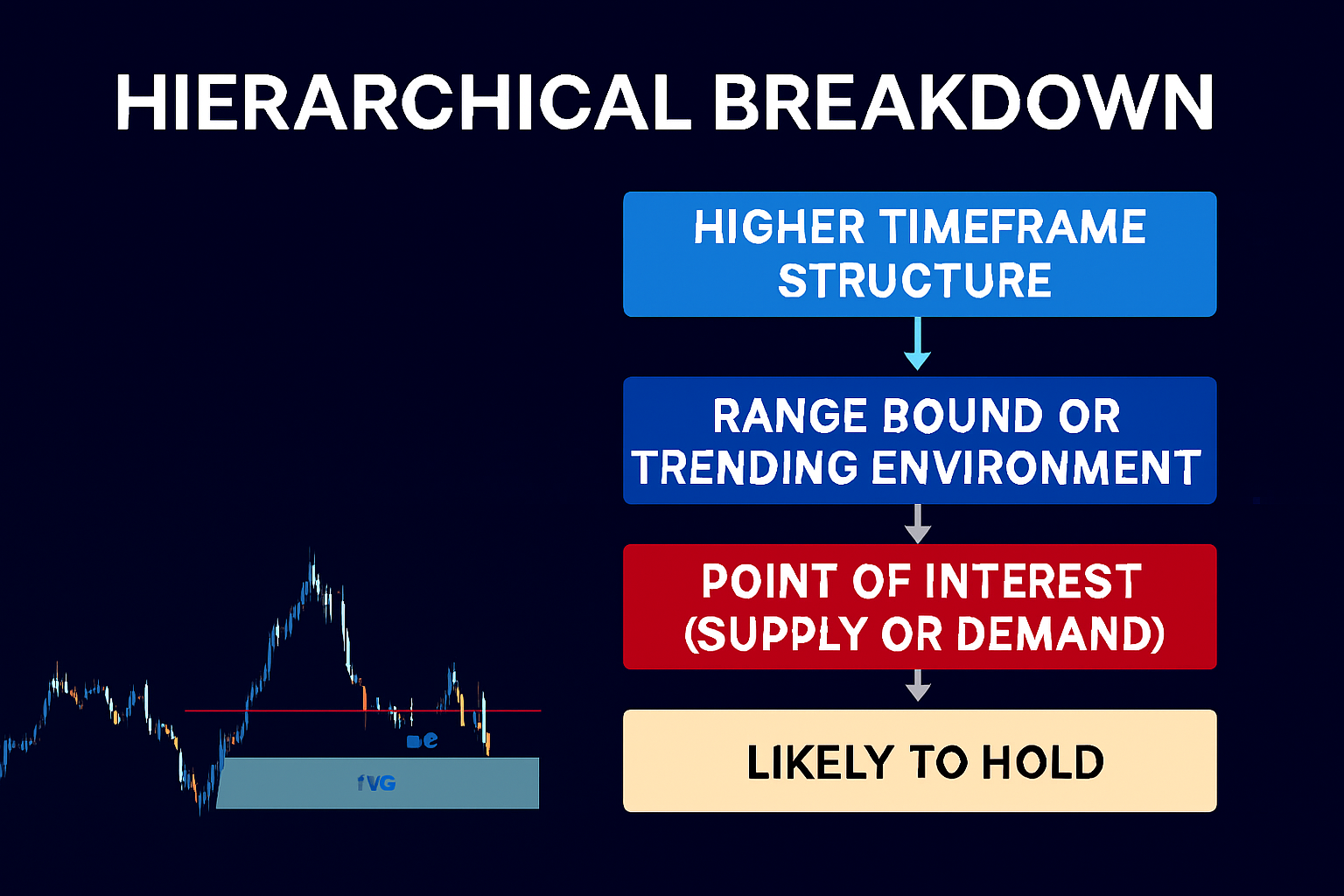

1. CORE HIERARCHY (NON‑NEGOTIABLE)

⬇️ HTF Momentum (SMA100/200)

⬇️ HTF Structure (Weekly/Daily Swing)

⬇️ LTF Structure (MSS / SMS)

Structure gives permission. Momentum gives authority.

2. STEP‑BY‑STEP DECISION FLOW

STEP 1 — WHERE IS PRICE COMING FROM? (HTF ORIGIN)

Purpose: define expectation.

Confirm: – Has price tapped a Weekly/Daily POI? – HTF Supply / Demand – OB / QMR – Major range extreme – External liquidity

Outcome: – At HTF POI → Expect reaction / corrective behavior – No HTF POI tapped → Expect continuation with prevailing bias

STEP 2 — HTF TREND & CONTROL

Purpose: define allowed trade direction.

Confirm: – Weekly structure – Daily structure – Current swing (HH/HL or LH/LL)

Rules: – Trade with HTF trend by default – Countertrend allowed only after MSS → SMS

STEP 3 — MARKET PHASE (MOST IMPORTANT FILTER)

A. STRONG TREND PHASE

Conditions: – Price above (bull) or below (bear) SMA100 & SMA200 – SMA100 > SMA200 (bull) or < (bear) – Clear slope, shallow pullbacks

Implications: – Momentum > Location – Premium/Discount is secondary – SMA100 = dynamic continuation zone – Mid‑range setups are valid

B. CORRECTIVE / RANGE PHASE

Conditions: – SMA100/200 flat, overlapping, or crossed – Deep retracements – Recent HTF POI tap

Implications: – Location > Momentum – Premium/Discount is mandatory – Extremes only – Mid‑range is invalid

3. PREMIUM / DISCOUNT AUTHORITY

| Market Phase | PD Authority |

| Strong Trend | Secondary |

| Corrective | Mandatory |

Rules: – Do not invalidate trades solely on PD in strong trend – Always respect PD in corrective phase

4. STRUCTURE CONFIRMATION (PERMISSION LAYER)

Always confirm: – MSS or SMS in trade direction – No protected HTF level violated

Rules: – No structure = no trade – MSS ≠ trend change – SMS = confirmation

5. TREATMENT OF COUNTERTREND SETUPS

In Strong Trend:

- Countertrend setups = scalps only

- Require MSS + liquidity

- Reduced size, small targets

- Exit before SMA100

In Corrective Phase:

- Countertrend setups at HTF Premium/Discount

- MSS → SMS allows reversal swing

6. CONTINUATION LOGIC AFTER DEEP RETRACEMENT

Bullish case: – Price retraces into deep discount – SMA100/200 flatten or overlap – Price reclaims SMA100/200 – MSS + SMS to upside

→ Bullish continuation (trend resumption)

Bearish case: exact inverse.

7. TRADE MANAGEMENT INTENT

Hold Longer When:

- HTF trend aligns

- Market phase = strong trend

- SMA100/200 respected

- No HTF structure break

Scalp & Exit Quickly When:

- Trade is countertrend

- Market phase = corrective

- Trading reaction, not control

8. DECISION TABLE (GO / NO‑GO)

| Context | Structure | SMA100/200 | Trade Type | Action |

| Uptrend | No MSS | Strong slope | Sell | ❌ No trade |

| Uptrend | MSS+SMS | Strong slope | Sell | ⚠️ Scalp only |

| Uptrend | MSS+SMS | Flat/overlap | Sell | ✅ Reversal allowed |

| Uptrend | HL intact | Strong slope | Buy | ✅ Continuation |

| Downtrend | No MSS | Strong slope | Buy | ❌ No trade |

| Downtrend | MSS+SMS | Strong slope | Buy | ⚠️ Scalp only |

| Downtrend | MSS+SMS | Flat/overlap | Buy | ✅ Reversal allowed |

| Downtrend | LH intact | Strong slope | Sell | ✅ Continuation |

9. FINAL OPERATING PRINCIPLES

- Momentum defines probability

- Structure defines timing

- Location defines precision

When all three align → press. When two align → reduce size / scalp. When one aligns → stand aside.

LIMIT ORDERS:

- ONLY when Set Up Aligns with Structure (Prevailing Trend) + Volume Cluster at POI.

Market Orders:

- Wait for Candlestick Confirmations (Especially counter trend Set Ups or Against strong sentimental)

Don’t trade against a spike move That Accumulated close to POI (Or choppy One-Sided moves into my POI), watch for Reversal candlestick pattern till Protected Low gets taken Out.

(Look for clean displacement into your POI)

If there is an Unmitigated Demand or supply zone below or Above POI wait for Candlestick Confirmations for reversals (Don’t trust POI, it is Inducement/SLQ for Another POI)

EDGEFINDER PRO:

- MACRO (EdgeFinder) tells you the long-term direction→ Only swing in that direction.

- TECHNICALS tell you where to execute→ Use supply/demand, volume profiles (POC), fair value gaps, liquidity, Algo structure orderflow.

- INTRADAY STRUCTURE tells you how to scalp→ You can take shorts even with a bullish macro —as long as they are counter-trend intraday scalps and your swing bias stays intact.

STOP LOSS

- Few Pips (5-10) below Protected Low or High

MONEY MANAGEMENT

- 10 Trade Rule on $15,000

- Maximum risk per trade = 1% ($150)

- If trading highly correlated pairs together, then split the risk between them.

- Max Drawdown per account is 1% per Day.

POSITION MANAGEMENT

- Don’t move SL to Break Even. Rule is TP or RP (Newly formed Strong High or Low)

MACRO NEWS

This applies only to macro news marked as high-impact (red news) on Forex Factory. It’s okay

to trade during less significant news.

- Don’t enter a trade during macro news

- BE trade 5 minutes before news release

- It’s okay to trade 10 mins after macro news or after it’s clear that post-macro volatility is over.

- It’s okay to re-enter your trade after macro news passed – but only if macro didn’t

- make a strong impact (increased volatility) on the market and if you manage to reenter

- for the same or better price as before

- Monster Macro news (the strongest macro news related directly to central bank rate

- policy) – don’t trade all affected pairs for the rest of the trading session.

HANDLING A DRAWDOWN

- Review screenshots and journal thoroughly –

- focus on what went well but also look for what went wrong and fix it.

- Don’t pause trading (at least not too long).

- Keep trading. Don’t Use smaller (Eg 50%) positions. Keep to the RULE.

DO NOT DO THIS (MY WEAKNESSES)

- Hope a loser will turn into a winner

- Trade impulsively based on emotions

- Force trades

- Revenge trading

- Fear of entering a trade (poor analysis)

- Close trades too soon (Risk Reward Ration should be at least 2RR)

- Add to losing positions

- Get swayed by FOMO (fear of missing out) – rather skip a trade than enter a bad one.

.

This plan governs decision‑making. Execution rules are applied only after this framework validates the trade idea.

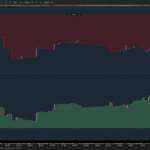

Live Stats (updated monthly)

- Total trades

- Win rate

- RR average

- Equity curve image

If you want to know more about my trading strategy, check the following pages and posts ;