A Complete Guide to Hybrid Smart Money & Orderflow Structure [Credits to DAX]

Introduction

The D-LuX Swing Trading Strategy is the culmination of six months of in-depth research, testing, and conceptual understanding of how prices move across multiple timeframes. It combines the Smart Money Concept (SMC) with Order Flow tools to detect swing-based trade setups using liquidity sweeps, breaks in structure, and volume-based confirmations.

This guide reflects a professional-level understanding developed through practical study and market observation, refined to help serious swing traders execute with precision.

1. Market Structure Mastery

Swing Structure Definitions

- Main Structure (Swing Highs/Lows): These are the significant pivot points on the higher timeframe (H4/H1) that break structure.

- Sub-Structure: The internal movements between the major swings, often used for refined entries.

🔍 Tip: Look for sub-structures forming HL or LH before the BOS – these are your confirmation layers.

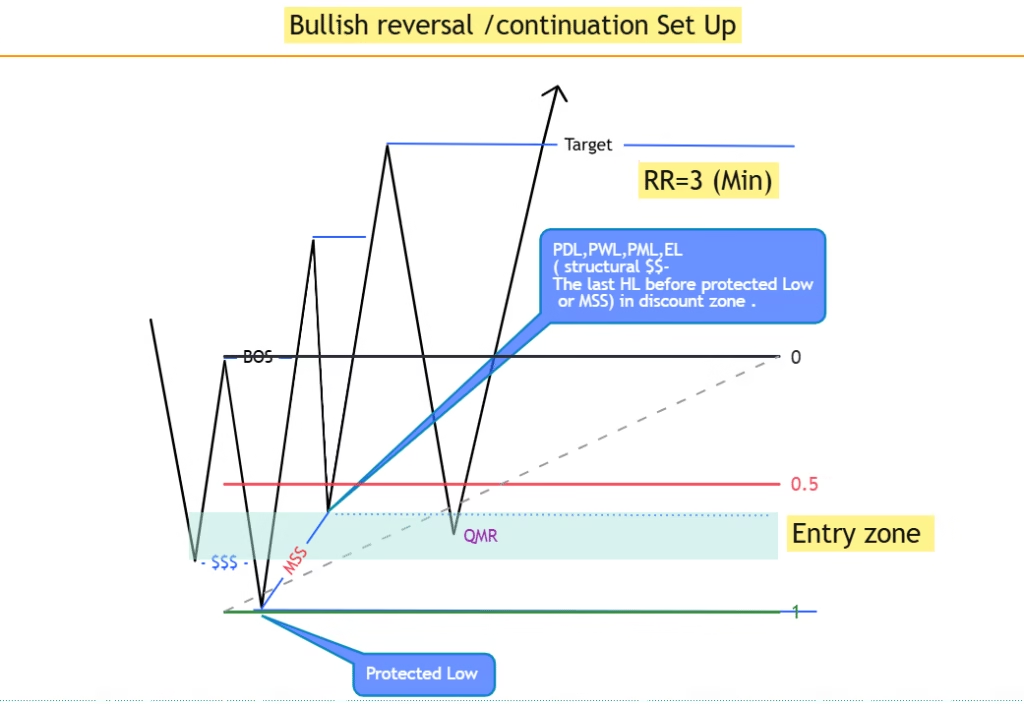

Structural Flow in a Bullish Scenario

- Sweep of Liquidity (grabbing external liquidity below/above key swing points)

- CHOCH (Change of Character): Break of internal structure against the trend, hinting at a shift.

- BOS (Break of Structure): Major swing is broken in the new direction.

- HL Formation: Pullback must form a clear higher low, with the previous swing protected.

- Second BOS: Confirms direction.

- Final Liquidity Sweep of HL: This is a trap to shake out weak hands before takeoff.

Illustration

2. Premium & Discount Zones

Use the 50% Fibonacci retracement tool:

- If buying → wait for price to enter Discount Zone (below 50%).

- If selling → wait for price to enter Premium Zone (above 50%).

📌 Golden Rule: Never buy in premium or sell in discount, regardless of trend bias. Always wait for mitigation.

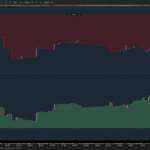

3. Orderflow Validation – Momentum Behind Price

Once structural conditions are met, orderflow tools help you validate the setup.

a) Cumulative Delta (CVD) Divergence

- Bullish Signal: Price makes a lower low, but delta makes a higher low → buyers absorbing sell pressure.

- Bearish Signal: Price makes a higher high, but delta makes a lower high → sellers absorbing buy pressure.

b) DOM (Depth of Market)

- Absorption: Aggressive market orders hit passive limit orders without price moving → large player absorption.

- Spoofing: Large orders appear but vanish = trap.

- Stacking: Clustering of orders at key prices = true intent.

🎯 These tools reveal the true intention behind candles.

4. Entry Checklist ✅❌

Structure Confluence:

- ✅ Price in correct zone (discount for buys, premium for sells)

- ✅ Liquidity sweep occurred

- ✅ CHOCH and BOS printed

- ✅ HL or LH formed and respected

- ✅ Second BOS confirms strength

- ✅ Final liquidity sweep before entry

Orderflow Confluence:

- ✅ Absorption detected at HL/LH

- ✅ CVD divergence aligns with intent

- ✅ DOM shows aggressive intent

- ✅ Session timing (London/NY) matches

5. Invalidation Rules ❌

Structure:

- ❌ Main swing low/high is broken (invalidates idea)

- ❌ No follow-up BOS after CHOCH

- ❌ HL/LH is too deep or inconsistent

- ❌ Entry taken in wrong zone

Orderflow:

- ❌ No absorption detected

- ❌ No trapped traders seen

- ❌ DOM shows spoofing or no commitment

6. DOM and Orderflow Nuance

Even though orderflow is often used for scalping, it complements swing trading by:

- Confirming when big players are entering

- Showing exhaustion of one side (via delta or DOM)

- Highlighting false breakouts via spoofing

How to use DOM here:

- Watch for aggressive market buys into stacked sell orders that don’t move price = seller absorption → bullish

- If large spoofed orders disappear = no conviction = avoid entry

7. Summary Thought Process (D-LuX Logic)

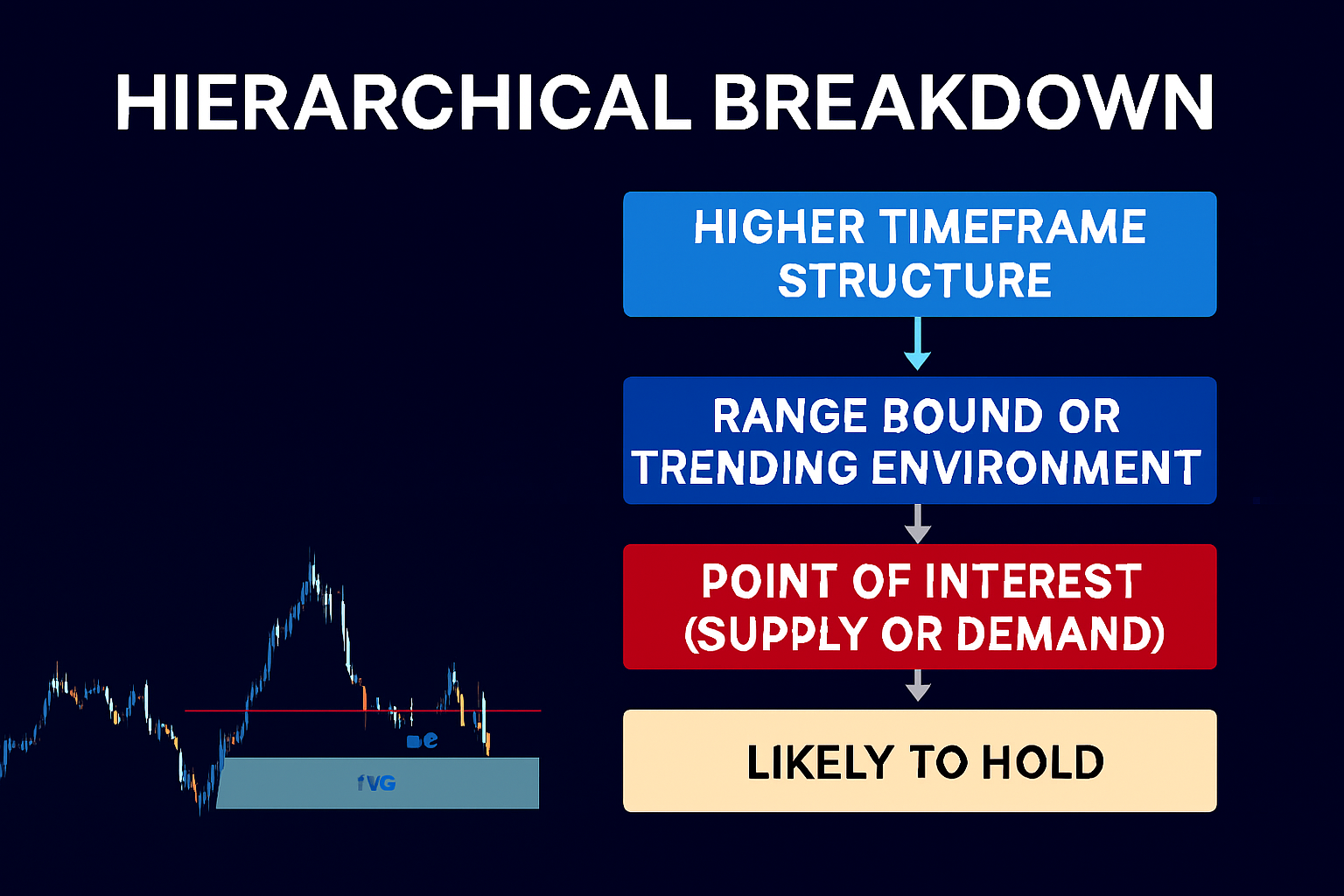

✅ Structure first (macro to micro)

✅ Wait for price to come to your level (discount/premium)

✅ Use CHOCH + BOS to confirm shift

✅ Add orderflow layer (DOM/CVD) to validate intent

✅ Avoid emotional entries – only execute complete checklist

✨ The result is a highly disciplined, data-driven swing trade setup with sniper-like accuracy.

8. Market Condition Checklist (Tailored for D-LuX)

🔹 Step 1: Identify Market Environment

| Condition | Trending | Ranging |

|---|---|---|

| Clear BOS and HL/LH forming | ✅ Yes | ❌ No |

| Price respecting swing structure | ✅ Yes | ❌ No |

| Wide impulsive moves, narrow pullbacks | ✅ Yes | ❌ No |

| Equal highs/lows forming repeatedly | ❌ No | ✅ Yes |

| Price bouncing between fixed zones | ❌ No | ✅ Yes |

| No clear CHOCH → BOS sequence | ❌ No | ✅ Yes (fakeouts) |

🔹 Step 2: Tools & Visual Confirmation

| Indicator or Tool | Trending Bias | Ranging Bias |

| 50 EMA / Trendline | Price riding above/below with clean structure | Crossing up/down frequently |

| CVD (Delta) | Shows real divergence at swing HL/LH | No consistent divergence |

| DOM | Strong stacking & holding near structural zones | Random spoofing, no clear buyer/seller intent |

🔹 Step 3: Decision Filter for Entry

If Market is Trending:

✅ Proceed with full D-LuX sequence:

- Sweep of liquidity → CHOCH → BOS → HL/LH → BOS → Entry

- Use FVG + Orderflow confluence at HL/LH

If Market is Ranging:

⚠️ Only trade near range boundaries:

- Sweep of range high/low → CHOCH → BOS into middle of range

- Confirm with strong absorption and trap detection

- Avoid mid-range entries — wait for extremes!

🚫 Avoid Trading When:

- No BOS/CHOCH for several sessions

- Price is in mid-zone between premium and discount with no clear intent

- CVD and DOM show no aggression

- Price is compressing (triangle/flag) inside the range with no expansion

🧠 Quick Mental Cue:

“If the market builds and respects swing structure, I execute the full D-LuX strategy.

If it rotates between extremes, I only trade the edges — and with extra confirmation.”

9. Closing Thoughts

You’ve just walked through a hybrid pro-level strategy combining smart money structure and advanced volume profiling. With real market data, this becomes a powerful edge for swing trading across Forex majors, minors, and exotics.

More …

By D-LuX – Trading with Structure, Logic, and Precision.