Read the Auction Process Like a Pro

What is Market Profile?

Market Profile is a charting technique developed by Peter Steidlmayer to visualize how the market distributes price and time. It’s not a trading system, but a framework that shows you where the market spent most of its time (value) and where it moved quickly (imbalances).

Instead of only looking at price movement, Market Profile helps traders answer:

- Where is the fair value of the market?

- Is the market balanced or trending?

- Which price levels are likely to attract or reject price today?

🔸 What Market Profile Looks Like

Visually, Market Profile can be seen as a vertical distribution on the side of your price chart:

1324.00 | A B C D E

1323.00 | A B C D E F G

1322.00 | A B C D E F G H I J (POC)

1321.00 | A B C D E F G

1320.00 | A B C D E

Each letter block represents a 30-minute session (A = first 30 min, B = next, etc.).

🔸 How to Read a Market Profile

- POC (Point of Control): Strong magnet. Price often revisits it.

- Value Area (VAH & VAL): Use them as support/resistance. Breakouts above/below can signal imbalance.

- Developing Value: Watch how value is shifting across days. Is it overlapping (balanced) or migrating (trending)?

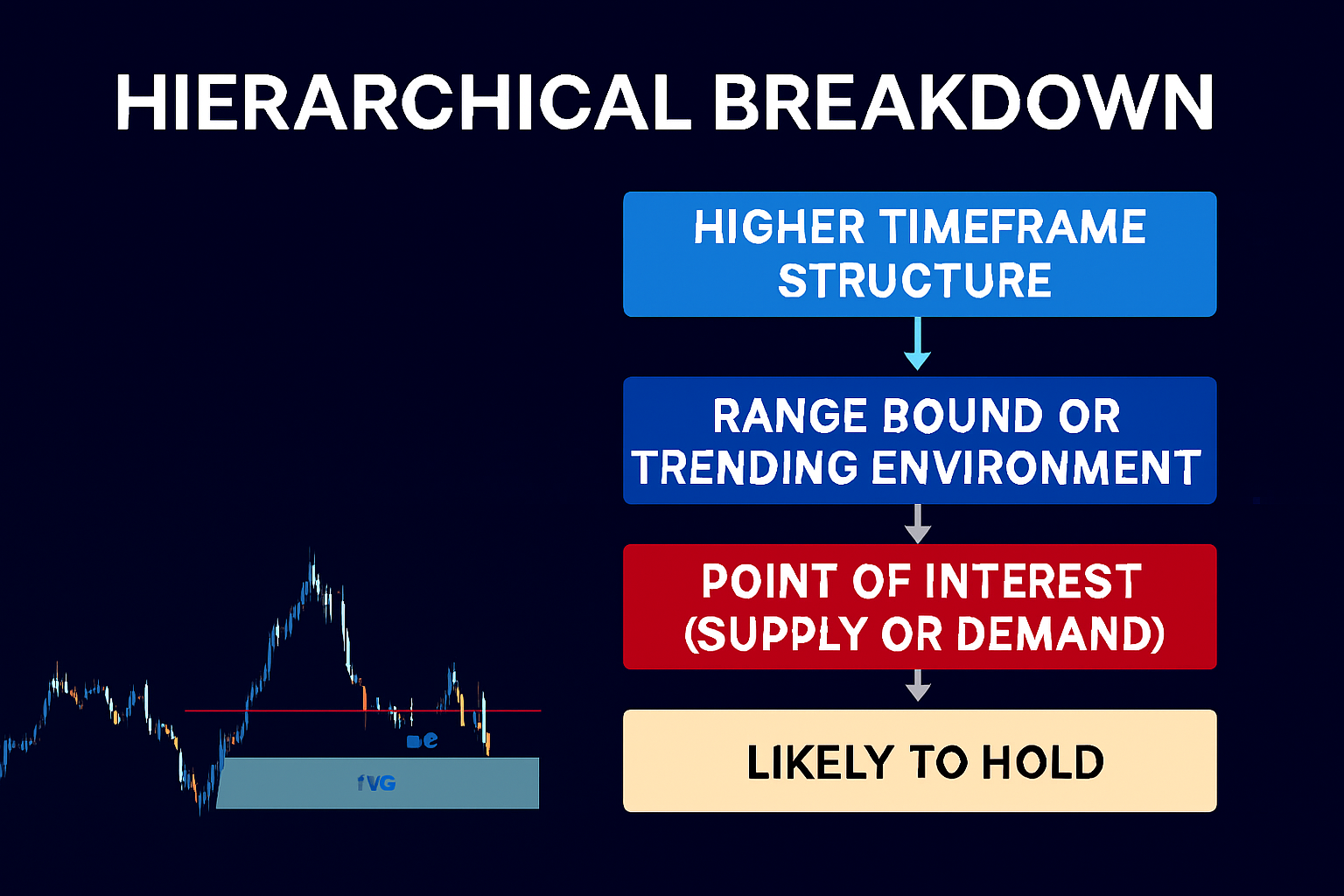

- Balanced vs. Imbalanced Profiles:

- Balanced = Range market → Fade extremes

- Imbalanced = Trending → Join the trend after pullback

Key Market Profile Terms

| Term | Definition |

|---|---|

| TPO (Time Price Opportunity) | Each time a price is traded during a specific time interval (usually 30 minutes). |

| Value Area (VA) | The range where approximately 70% of TPOs occurred (considered fair value). |

| Point of Control (POC) | The price level with the most TPOs – the fairest price of the session. |

| Value Area High (VAH) | Top boundary of the value area – potential resistance. |

| Value Area Low (VAL) | Bottom boundary of the value area – potential support. |

| High Volume Node (HVN) | Price zone with high acceptance (market comfortable). |

| Low Volume Node (LVN) | Price zone with low acceptance (market rejection zone). |

How to Read Market Profile ( summary)

Market Profile is built on auction market theory:

- When the market is balanced, price rotates between VAH and VAL.

- When the market is imbalanced, price breaks away from value to find new value areas.

Key insights:

- POC acts as a magnet for price during the session.

- VAH/VAL often act as support/resistance.

- LVNs can create strong reversals when tested.

Types of Market Profile Days

| Type | Behavior | Strategy |

|---|---|---|

| Normal Day | Price stays in a small range | Fade extremes |

| Normal Variation | Small breakout after initial balance | Trade breakouts from balance |

| Trend Day | Price keeps moving in one direction | Trade pullbacks in trend |

| Double Distribution | Two separate value areas | Trade LVNs between areas |

| Neutral Day | Breaks both sides of range | Fade toward POC |

Proven and Tested Session Sentiment Strategy

Here’s a proven session sentiment approach:

- Open Inside Previous Day Value Area

- Market accepted yesterday’s value → Expect balance

- No trend trades unless a breakout occurs

- Open Outside Value Area but Inside Previous Day Range

- VAH/VAL may act as bounce points

- Look for rejection trades at value boundaries

- Open Outside Both Value Area and Range

- Market in price discovery mode

- Look for reversals or new value building

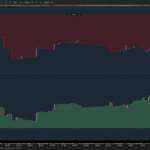

🔹 Market Profile vs Volume Profile

- Market Profile = based on time spent at price levels.

- Volume Profile = based on volume traded at price levels.

✅ Pro Tip: Use both together. Market Profile shows time-based acceptance, while Volume Profile shows actual participation.

🔍 Key Difference: What they measure

| Feature | Market Profile (MP) | Volume Profile (VP) |

|---|---|---|

| Focus | Time spent at each price level | Volume traded at each price level |

| Unit of Measure | TPOs (Time Price Opportunities) – shows how long price stayed there | Actual trade volume at each price |

| Data Basis | Time-based (e.g. 30-minute letters A–Z) | Tick volume or real volume (if available) |

| More Accurate? | More conceptual – based on time distribution | More precise – shows where traders put money |

🎯 Example:

Let’s say XAUUSD trades for 60 minutes:

- Market Profile shows the price where the market spent the most time (POC based on TPO count).

- Volume Profile shows the price where the market traded the most contracts/lots (POC based on volume).

✅ So you might have a POC at 1952 in Market Profile but a Volume POC at 1950 in Volume Profile. That tells you:

“Price spent more time at 1952, but more orders were executed at 1950.”

That difference can be useful in understanding where the market was comfortable vs. where it was most active.

📊 Visual Difference (simplified)

Market Profile (TPO):

lessCopierModifier1954.00 | B C

1953.00 | A B C D

1952.00 | A B C D E F G H I ← POC (most TPOs)

1951.00 | A B C

1950.00 | A

Volume Profile:

yamlCopierModifier1954.00 | ██ (low volume)

1953.00 | ██████

1952.00 | ██████████

1951.00 | ███████

1950.00 | █████████████████ ← POC (highest volume)

Applying Market Profile to any instrument Ex, Gold (XAUUSD)

- Mark previous day’s VAH, VAL, POC before London open.

- Identify opening location relative to these levels.

- Watch for POC re-tests, VA bounces, and LVN rejections.

- Use Developing POC shift to confirm trend continuation.

- Combine with liquidity concepts for precision entries.

Final Thoughts

Market Profile is powerful because it reveals the market’s underlying auction process. By reading where the market found value yesterday, you can anticipate how it might behave today.

Key Takeaway:

Use yesterday’s value to determine today’s bias, combine with volume data for precision, and always confirm with price action.