In today’s fast-paced world, achieving financial freedom is a goal many aspire to attain. The ability to generate passive income plays a pivotal role in this pursuit. Passive income empowers individuals to build wealth, create financial security, and live life on their own terms. Whether you’re aiming to supplement your current income or break free from the constraints of a traditional job, mastering the art of generating passive income is key. This comprehensive guide will walk you through the strategies and avenues to unlock financial freedom through passive income streams.

>> Here’s the Proven Way to Make $100-$200 Daily with 0 Investment– Watch This FREE Video and Start Now >>

1. Understand the Concept of Passive Income

Before diving into specific strategies, it’s essential to grasp the concept of passive income. Passive income refers to earnings derived from ventures in which you are not actively involved on a day-to-day basis. Unlike traditional employment, where you exchange time for money, passive income allows you to generate revenue with minimal ongoing effort once the initial setup is complete. Examples include rental properties, dividend-paying stocks, royalties from creative works, and online businesses.

2. Assess Your Financial Goals and Risk Tolerance

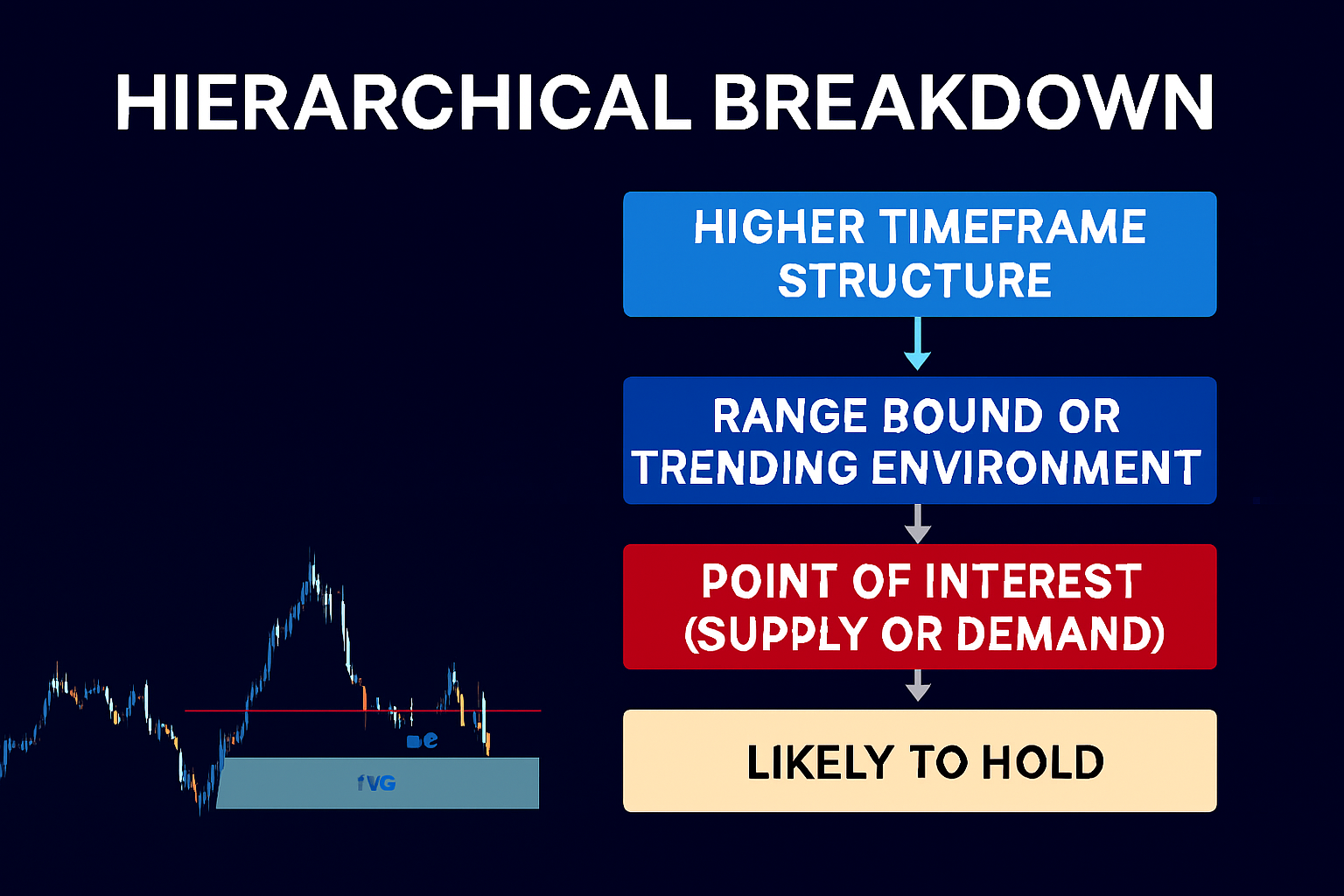

Identifying your financial objectives and risk tolerance is a crucial first step in building passive income streams. Consider factors such as your desired level of income, time horizon, and comfort level with various investment vehicles. Are you looking for short-term gains or long-term stability? Understanding your financial landscape will guide you in selecting the most suitable passive income strategies aligned with your objectives.

3. Explore Diverse Passive Income Opportunities

The beauty of passive income lies in its diversity of opportunities. From real estate investments and stock market ventures to online businesses and peer-to-peer lending platforms, there are countless avenues to explore. Each option carries its own set of risks and rewards, requiring careful consideration based on your preferences and financial situation. Diversifying your passive income streams can mitigate risk and enhance overall stability.

4. Real Estate Investments

Investing in real estate remains a cornerstone of passive income generation. Whether through rental properties, real estate investment trusts (REITs), or crowdfunding platforms, real estate offers opportunities for ongoing rental income, property appreciation, and tax benefits. Conduct thorough research, evaluate market conditions, and leverage resources such as property management services to maximize returns and minimize risks.

5. Stock Market Strategies

Participating in the stock market presents another avenue for passive income generation. Dividend-paying stocks, index funds, and dividend reinvestment plans (DRIPs) offer opportunities to earn regular income through dividends and capital appreciation. Adopt a long-term investment approach, diversify your portfolio across sectors and asset classes, and stay informed about market trends to optimize your returns over time.

6. Create Digital Assets

In the digital age, creating and monetizing digital assets has emerged as a lucrative passive income strategy. Whether through blogging, affiliate marketing, creating online courses, or developing mobile apps, digital entrepreneurship offers scalability and flexibility. Invest time and effort in building valuable content, optimizing for search engines, and cultivating a loyal audience to generate passive income through advertising, affiliate commissions, and product sales.

7. Leverage the Power of Passive Income Streams

Once you’ve established passive income streams, focus on optimizing and expanding your portfolio over time. Reinvest earnings, monitor performance metrics, and adapt your strategies based on market dynamics and emerging opportunities. Embrace a growth mindset, continuously seek knowledge, and remain agile in navigating the evolving landscape of passive income generation.

8. Monitor Progress and Adjust Accordingly

Regularly assess the performance of your passive income streams and adjust your approach as needed. Keep track of income sources, expenses, and overall profitability to ensure your financial goals remain on track. Be prepared to pivot if certain strategies underperform or market conditions shift. By staying proactive and adaptable, you can unlock the full potential of passive income to achieve financial freedom and live life on your own terms.

>> Here’s the Proven Way to Make $100-$200 Daily with 0 Investment– Watch This FREE Video and Start Now >>

Understand the Concept of Passive Income

Passive income stands as a beacon of financial liberation in today’s world. Unlike active income, which demands continuous effort, passive income allows you to earn money with minimal ongoing involvement. Understanding this concept is pivotal to unlocking the path to financial freedom.

- Definition: Passive income encompasses earnings derived from activities requiring little to no direct effort once established.

- Types: Examples include rental income, dividends from stocks, interest from bonds, royalties from creative works, and revenue from online businesses.

- Benefits: Passive income offers financial stability, flexibility, and the potential for wealth accumulation over time.

- Initial Effort: While passive income streams require upfront investment and effort, they offer long-term rewards.

- Time Freedom: Passive income grants the freedom to pursue passions, spend time with loved ones, and enjoy life outside traditional employment.

- Risk Management: Diversifying passive income sources helps mitigate risks associated with individual investments.

- Growth Potential: Continuously reinvesting passive income can lead to exponential growth and increased financial security.

Mastering passive income empowers individuals to break free from the constraints of conventional employment and achieve lasting financial independence. Start your journey today by exploring diverse passive income opportunities and embracing the potential for a brighter financial future.

Assess Your Financial Goals and Risk Tolerance

Embarking on the quest for financial freedom requires a clear understanding of your objectives and tolerance for risk. By assessing your financial goals and risk tolerance, you lay the foundation for a tailored approach to wealth creation and preservation.

- Define Objectives: Identify short-term needs, such as debt repayment or emergency funds, and long-term aspirations like retirement savings or wealth accumulation.

- Quantify Goals: Set specific, measurable targets for income, savings, investments, and net worth to guide your financial strategy.

- Time Horizon: Consider the time frame for achieving your goals and adjust investment strategies accordingly.

- Risk Appetite: Assess your comfort level with market volatility, loss potential, and investment uncertainty.

- Asset Allocation: Allocate assets across different investment classes based on your risk tolerance and financial objectives.

- Diversification: Spread investments across a variety of assets to minimize risk and optimize returns.

- Review and Adjust: Regularly review your financial goals and risk tolerance, making adjustments as circumstances change.

By aligning your financial goals with your risk tolerance, you can create a customized roadmap to financial success. Stay focused, stay disciplined, and adapt as needed to achieve your aspirations.

Explore Diverse Passive Income Opportunities

Diversifying your passive income portfolio is essential for long-term financial success. By exploring a range of opportunities, you can maximize earnings potential while spreading risk across various asset classes and income streams.

- Real Estate Ventures: Invest in rental properties, real estate investment trusts (REITs), or crowdfunding platforms to earn rental income and benefit from property appreciation.

- Stock Market Participation: Consider dividend-paying stocks, index funds, or peer-to-peer lending platforms for steady returns and capital appreciation.

- Digital Entrepreneurship: Monetize online content through blogging, affiliate marketing, or creating digital products like e-books or online courses.

- Peer-to-Peer Lending: Earn interest income by lending funds to individuals or businesses through online lending platforms.

- High-Yield Savings Accounts: Park funds in savings accounts or certificates of deposit (CDs) offering competitive interest rates for a low-risk source of passive income.

- Dividend Reinvestment Plans (DRIPs): Automatically reinvest dividends earned from stocks to purchase additional shares, compounding your returns over time.

- Rental Income from Assets: Lease out equipment, vehicles, or other assets to generate ongoing revenue without active involvement.

- Royalties and Licensing: Earn passive income from royalties on intellectual property, such as books, music, or patents, through licensing agreements.

By diversifying your passive income streams across a spectrum of opportunities, you can build resilience against market fluctuations and unlock the full potential of passive income for financial freedom and abundance.

Real Estate Investments

Real estate stands as a cornerstone of passive income generation, offering opportunities for steady cash flow, long-term appreciation, and portfolio diversification. Understanding the intricacies of real estate investments empowers individuals to build wealth and achieve financial freedom.

- Rental Properties: Invest in residential or commercial properties to generate passive income through rental payments from tenants.

- Real Estate Investment Trusts (REITs): Access the real estate market without directly owning property by investing in REITs, which often provide attractive dividends.

- Crowdfunding Platforms: Participate in real estate projects with lower capital requirements through crowdfunding platforms, earning returns based on project performance.

- Property Flipping: Buy undervalued properties, renovate or improve them, and sell for a profit, leveraging market fluctuations for short-term gains.

- Tax Benefits: Take advantage of tax deductions, depreciation, and other incentives available to real estate investors to maximize returns.

- Property Management: Consider outsourcing property management tasks to professionals to streamline operations and minimize hands-on involvement.

- Market Research: Conduct thorough market analysis to identify emerging trends, evaluate property values, and assess rental demand for informed investment decisions.

- Financing Options: Explore various financing options, such as mortgages, private loans, or seller financing, to leverage capital and expand your real estate portfolio.

Real estate investments offer a myriad of opportunities for passive income generation and wealth accumulation. By mastering the fundamentals of real estate investing and staying attuned to market dynamics, individuals can unlock the potential for financial prosperity and long-term success in the real estate market.

>> Here’s the Proven Way to Make $100-$200 Daily with 0 Investment– Watch This FREE Video and Start Now >>

Stock Market Strategies

The stock market presents vast opportunities for passive income generation through dividend-paying stocks, index funds, and other investment vehicles. Implementing effective strategies can help investors capitalize on market trends and achieve financial goals.

- Dividend Investing: Focus on acquiring stocks with consistent dividend payouts, providing a steady stream of passive income.

- Growth Stocks: Identify companies with strong growth potential and reinvest dividends for long-term capital appreciation.

- Index Funds: Invest in diversified index funds to passively track market performance and benefit from broad market growth.

- Dollar-Cost Averaging: Regularly invest fixed amounts in stocks over time to mitigate the impact of market volatility.

- Dividend Reinvestment Plans (DRIPs): Automatically reinvest dividends to purchase additional shares and compound returns.

- Value Investing: Seek undervalued stocks with potential for price appreciation, emphasizing fundamental analysis and market research.

- Sector Rotation: Rotate investments across different sectors to capitalize on cyclical market trends and diversify risk.

- Risk Management: Set stop-loss orders and maintain a diversified portfolio to protect against significant losses.

- Long-Term Perspective: Adopt a patient approach, focusing on long-term investment goals rather than short-term market fluctuations.

By employing a combination of strategic approaches, investors can navigate the complexities of the stock market and harness its potential for passive income generation. With diligence, patience, and a focus on long-term wealth accumulation, investors can achieve financial success and build a solid foundation for the future.

Create Digital Assets

In the digital era, creating and monetizing digital assets has become a lucrative avenue for passive income. By leveraging technology and creativity, individuals can generate revenue streams that require minimal ongoing effort, offering scalability and flexibility.

- Blogging: Create engaging content on niche topics, monetizing through advertising, sponsored content, and affiliate marketing.

- Affiliate Marketing: Promote products or services through affiliate links on websites, blogs, or social media platforms to earn commissions on sales.

- Online Courses: Develop educational content on platforms like Udemy or Teachable, earning passive income from course sales.

- E-books: Write and self-publish e-books on platforms like Amazon Kindle Direct Publishing, earning royalties on sales.

- Mobile Apps: Develop and monetize mobile applications through in-app purchases, subscriptions, or advertising revenue.

- YouTube Channel: Create videos on topics of interest, monetizing through ad revenue, sponsorships, and merchandise sales.

- Membership Sites: Offer premium content or community access through membership sites, charging subscription fees for exclusive benefits.

- Photography or Art: License digital images or artwork for use in publications, websites, or merchandise sales.

By investing time and creativity into building digital assets, individuals can establish diverse sources of passive income that offer long-term financial benefits. With persistence and strategic marketing, digital entrepreneurs can unlock the full potential of their creations and achieve financial freedom in the digital landscape.

Leverage the Power of Passive Income Streams

Passive income streams offer the promise of financial freedom by generating revenue with minimal ongoing effort. By leveraging these streams effectively, individuals can create a steady source of income that supports their lifestyle and long-term goals.

- Diversification: Spread investments across various passive income streams to mitigate risk and maximize returns.

- Reinvestment: Reinvest earnings into expanding existing streams or exploring new opportunities for growth.

- Automation: Utilize automation tools and systems to streamline passive income generation and minimize manual intervention.

- Scalability: Focus on building scalable income streams that have the potential to grow exponentially over time.

- Adaptability: Stay informed about market trends and adjust strategies to capitalize on emerging opportunities.

- Passive vs. Active Management: Balance passive income streams that require minimal oversight with active income streams that may require more hands-on involvement.

- Long-Term Perspective: Maintain a patient approach and prioritize sustainable, long-term income growth over short-term gains.

By harnessing the power of passive income streams, individuals can create a pathway to financial independence and unlock the freedom to live life on their own terms. With careful planning, perseverance, and a commitment to ongoing growth, the possibilities for passive income are endless.

Monitor Progress and Adjust Accordingly

Monitoring the performance of passive income streams is crucial for optimizing returns and ensuring financial goals are met. By regularly assessing progress and making necessary adjustments, individuals can maintain momentum towards financial freedom.

- Establish Metrics: Define key performance indicators (KPIs) such as revenue, expenses, and profitability for each passive income stream.

- Track Income Sources: Monitor the performance of each income source, identifying trends and areas for improvement.

- Analyze Expenses: Review expenses associated with passive income streams, seeking opportunities to reduce costs and maximize profitability.

- Assess Market Conditions: Stay informed about market trends and economic indicators that may impact passive income streams.

- Reinvest Earnings: Consider reinvesting earnings into high-performing streams or exploring new opportunities for growth.

- Stay Flexible: Be prepared to adjust strategies and reallocate resources based on changing market dynamics or personal circumstances.

- Seek Feedback: Solicit feedback from peers, mentors, or financial advisors to gain insights and perspectives on passive income strategies.

- Review Regularly: Schedule regular reviews of passive income performance to ensure goals remain on track and make adjustments as needed.

By monitoring progress and adapting strategies accordingly, individuals can optimize their passive income streams for long-term success and achieve their financial objectives with confidence. With diligence and proactive management, the journey towards financial freedom becomes both achievable and sustainable.

Conclusion

Unlocking financial freedom through passive income requires dedication, strategic planning, and a willingness to explore diverse opportunities. By understanding the principles of passive income, assessing your financial goals, and leveraging a combination of investment vehicles and digital assets, you can build multiple streams of passive income that support your desired lifestyle. Remember to stay informed, monitor progress, and adapt your strategies as you progress on your journey towards financial independence. With perseverance and determination, you can unlock the door to a future of limitless possibilities and true financial empowerment.

>> Here’s the Proven Way to Make $100-$200 Daily with 0 Investment– Watch This FREE Video and Start Now >>

Thank you for taking the time to read my article “Unlock Financial Freedom: The Ultimate Guide to Generating Passive Income!”, hope it helps!