Cryptocurrency is a rapidly growing industry, attracting new investors and enthusiasts eager to profit from digital currencies. For beginners, the prospect of making money in cryptocurrency can seem daunting. This guide provides a clear roadmap for newcomers, offering tips on how to start and grow your investments in the crypto space.

>> Here’s the Proven Way to Make $100-$200 Daily with 0 Investment – Watch This FREE Video and Start Now >>

1. Understand the Basics of Cryptocurrency

Before diving into investments, it’s crucial to grasp the fundamentals. Cryptocurrency is digital money that uses encryption to secure transactions and control the creation of new units. Bitcoin was the first cryptocurrency, but now there are thousands of alternatives like Ethereum, Litecoin, and Ripple. Researching these currencies, blockchain technology, and how they operate is a must before investing.

2. Choose a Secure Cryptocurrency Exchange

A cryptocurrency exchange is where you’ll buy, sell, and trade digital currencies. Some of the most popular exchanges include Coinbase, Binance, and Kraken. When choosing an exchange, prioritize security, fees, and user experience. Look for platforms with a strong reputation and a history of safeguarding user assets. Many beginners also prefer exchanges that offer mobile apps for easy access.

3. Start Small and Diversify (Cryptocurrency)

The crypto market is known for its volatility, with prices often swinging dramatically in a short period. As a beginner, it’s wise to start with a small investment that you can afford to lose. Additionally, diversify your portfolio by investing in several cryptocurrencies instead of just one. This reduces risk as the value of different cryptocurrencies may fluctuate independently of each other.

4. Buy and Hold (HODL) Strategy

One of the most straightforward strategies for beginners is the “buy and hold” approach, often referred to in the crypto world as “HODLing.” The idea is to buy a cryptocurrency and hold onto it for a long time, ignoring short-term market fluctuations. Many investors have seen significant returns by holding onto currencies like Bitcoin and Ethereum for years, benefiting from their long-term growth.

5. Engage in Crypto Staking

Crypto staking is a process where you lock up your cryptocurrency holdings to support the operations of a blockchain network. In return, you earn rewards, typically in the form of additional cryptocurrency. Platforms like Binance and Kraken offer staking services for various cryptocurrencies. It’s a low-risk way to earn passive income, especially for those who plan to hold their assets long-term.

6. Participate in Initial Coin Offerings (ICOs)

An ICO is a fundraising method used by new cryptocurrency projects to launch their tokens. By investing in an ICO, you purchase tokens before they hit the open market. If the project succeeds, the token’s value could rise, offering significant returns. However, ICOs are risky as not all projects succeed, so thorough research is essential before committing funds.

7. Day Trading Cryptocurrency (Cryptocurrency)

For those who prefer a more active approach, day trading involves buying and selling cryptocurrencies within short periods to take advantage of market volatility. To succeed in day trading, you need to stay updated on market trends, news, and technical analysis. This method can be highly profitable, but it’s also more complex and risky, making it better suited for those with some experience or willingness to learn technical trading strategies.

8. Earn Cryptocurrency Through Airdrops and Bounties

Some cryptocurrency projects distribute free tokens through airdrops as a promotional strategy. To receive these, you typically need to hold a certain cryptocurrency or complete specific tasks like signing up for a platform or following their social media accounts. Additionally, bounties are tasks that reward you with cryptocurrency for completing simple actions like bug testing or writing reviews. While the earnings may be small, it’s an easy way for beginners to start building a crypto portfolio without any upfront investment.

>> Here’s the Proven Way to Make $100-$200 Daily with 0 Investment – Watch This FREE Video and Start Now >>

Understand the Basics of Cryptocurrency

Cryptocurrency is a digital or virtual form of currency that operates independently of traditional banks. With the rise of Bitcoin and other digital currencies, understanding the basics is key to navigating this new financial landscape. Here are six points to grasp the fundamentals of cryptocurrency.

- Decentralization: Unlike traditional currencies, cryptocurrencies operate on decentralized networks, typically using blockchain technology.

- Blockchain Technology: This is a digital ledger that records all transactions across a network, ensuring transparency and security.

- Popular Cryptocurrencies: Bitcoin, Ethereum, and Litecoin are some of the most well-known cryptocurrencies, each with unique features.

- Mining: Cryptocurrencies like Bitcoin are created through mining, a process where powerful computers solve complex math problems.

- Wallets: Cryptocurrency wallets store your digital coins, and they come in forms like hardware wallets or mobile apps.

- Volatility: Cryptocurrency values can fluctuate widely, offering potential for both profits and losses.

Understanding cryptocurrency basics is essential for anyone looking to explore or invest in this growing digital financial world.

Choose a Secure Cryptocurrency Exchange

Selecting a secure cryptocurrency exchange is crucial for safe trading and protecting your digital assets. With numerous exchanges available, knowing what to look for can help you make the right choice. Here are seven key points to consider when choosing a secure cryptocurrency exchange.

- Reputation: Research the exchange’s reputation by reading reviews and checking for any history of hacks or security breaches.

- Security Features: Look for exchanges with strong security features such as two-factor authentication (2FA) and cold storage for assets.

- Regulation: Choose an exchange that complies with local regulations, ensuring a safer and more reliable platform.

- Insurance: Some exchanges offer insurance on digital assets, providing additional protection in case of a security breach.

- User Interface: A user-friendly interface is essential for both beginners and experienced traders, making transactions smooth and efficient.

- Fees: Compare transaction fees across different platforms to avoid unexpected costs that could eat into your profits.

- Customer Support: Ensure the exchange offers reliable customer support in case you encounter issues or need assistance.

Choosing a secure cryptocurrency exchange is essential to safeguarding your assets and ensuring smooth trading experiences. Research thoroughly before making a decision.

Start Small and Diversify (Cryptocurrency)

When beginning your investment journey, starting small and diversifying your portfolio is a smart strategy to minimize risk and maximize potential returns. By gradually building your investments and spreading them across different asset types, you reduce the chances of significant losses. Here are seven key points on why you should start small and diversify.

- Manageable Risk: Starting small allows you to take calculated risks without overwhelming financial exposure.

- Learn as You Go: Investing small amounts helps you learn the ropes of the market, enabling you to gain experience without risking too much.

- Variety of Assets: Diversify across stocks, bonds, real estate, and cryptocurrencies to spread out your risk.

- Protect Against Market Volatility: A diversified portfolio helps cushion losses when one asset class underperforms.

- Compound Growth: Small investments can grow over time through compounding, especially when diversified.

- Minimize Emotional Decisions: Small, diversified investments help you avoid emotional reactions to market fluctuations.

- Increase Flexibility: Starting small provides more flexibility to adjust your portfolio as you gain confidence and market knowledge.

Starting small and diversifying your investments is a smart strategy that balances learning, risk management, and long-term growth potential.

Buy and Hold (HODL) Strategy

The “Buy and Hold” (HODL) strategy involves purchasing assets, such as stocks or cryptocurrencies, and holding onto them for the long term, regardless of short-term market fluctuations. This approach is popular among investors seeking to minimize trading risks. Here are five key points about the HODL strategy.

- Long-Term Growth: By holding assets over time, you benefit from the general upward trend of markets, allowing for substantial growth.

- Avoid Emotional Trading: HODLing helps you avoid panic selling during market dips, keeping emotions out of investment decisions.

- Lower Transaction Costs: Fewer trades mean lower fees, saving you money over the long term.

- Capitalizing on Compounding: Holding assets allows you to benefit from compounding returns as your investments grow over time.

- Simplicity: This strategy is simple to execute, requiring minimal effort once you’ve made your initial investment.

The Buy and Hold (HODL) strategy is ideal for patient investors looking to achieve long-term growth without the stress of frequent market moves. Patience and discipline are key to its success.

>> Here’s the Proven Way to Make $100-$200 Daily with 0 Investment – Watch This FREE Video and Start Now >>

Engage in Crypto Staking

Crypto staking allows you to earn passive income by holding certain cryptocurrencies in a wallet and supporting the blockchain network’s operations. It’s a popular way to grow your crypto assets without actively trading. Here are six points about crypto staking.

- Earn Rewards: By staking your crypto, you receive rewards in the form of additional tokens, similar to earning interest on a savings account.

- Supports Blockchain Security: Staking helps maintain the security and efficiency of blockchain networks by validating transactions.

- Minimal Effort: Once you stake your crypto, the process is largely automated, requiring little ongoing effort.

- Variety of Coins: Many cryptocurrencies, such as Ethereum and Cardano, offer staking options, allowing you to diversify your staking portfolio.

- Lower Risk: Unlike trading, staking provides steady, predictable returns without the need to monitor market fluctuations.

- Lock-up Periods: Some staking programs require you to lock your assets for a period, so consider this when choosing your staking platform.

Crypto staking is a simple and effective way to earn passive income while supporting the blockchain network, making it an appealing option for long-term crypto holders.

Participate in Initial Coin Offerings (ICOs)

Initial Coin Offerings (ICOs) offer a way to invest in new cryptocurrencies or blockchain projects before they launch. Participating in ICOs can provide early access to potentially lucrative investments. Here are six key points to consider.

- Early Investment Opportunity: ICOs allow you to invest in a project at its inception, often at lower prices before it hits major exchanges.

- Research Thoroughly: Investigate the project’s whitepaper, team, and technology to evaluate its potential and legitimacy.

- Understand the Risks: ICOs can be risky; many projects fail, and some may even be scams. Ensure you are aware of the risks involved.

- Regulatory Compliance: Check if the ICO complies with relevant regulations to avoid legal issues and ensure its legitimacy.

- Token Utility: Assess the utility of the tokens being offered—whether they have a clear use case within the project’s ecosystem.

- Diversify Investments: Avoid putting all your funds into a single ICO. Diversify to spread risk across multiple projects.

Participating in ICOs can be a rewarding investment strategy if approached with careful research and risk management. Evaluate each opportunity thoroughly to maximize your chances of success.

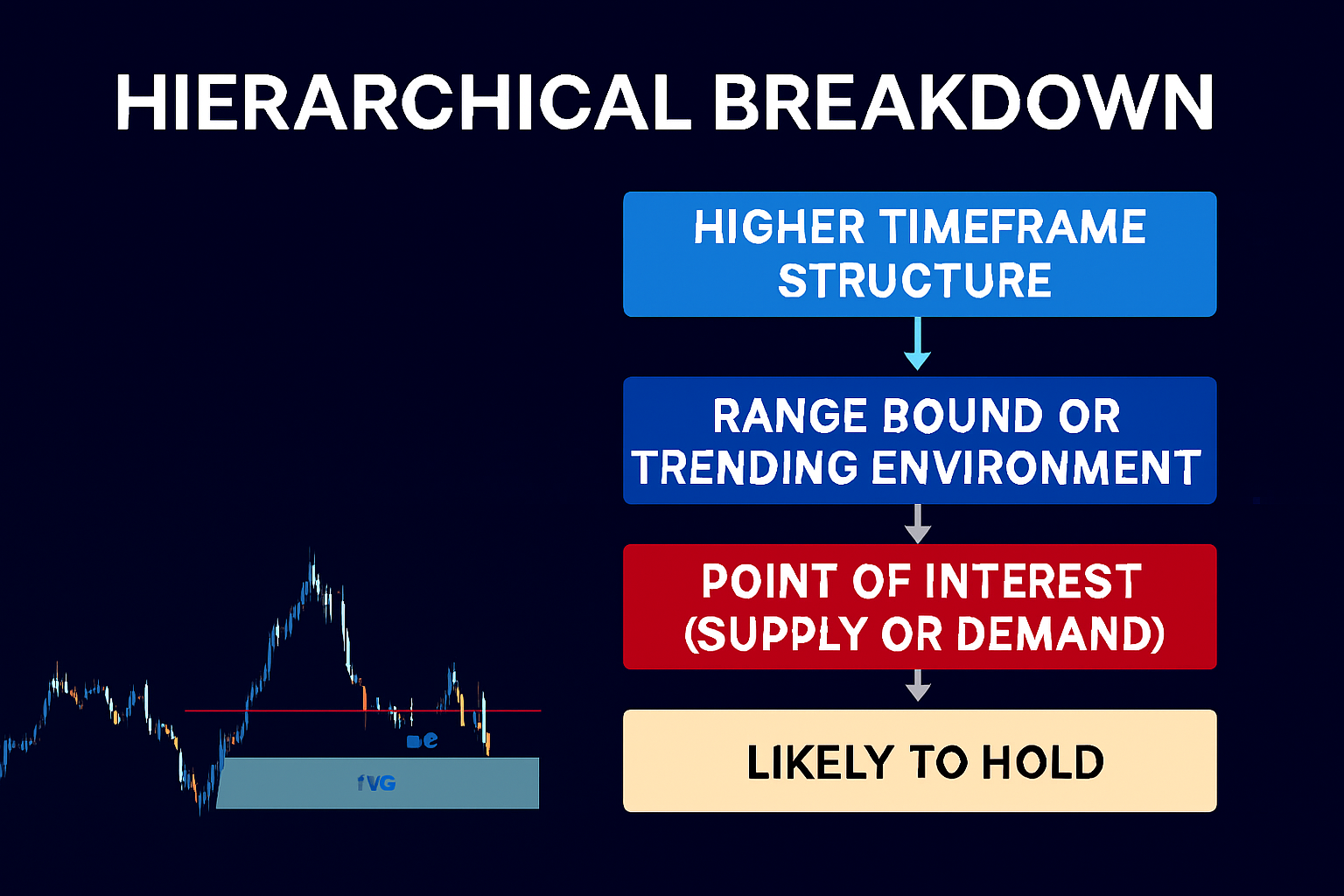

Day Trading Cryptocurrency (Cryptocurrency)

Day trading cryptocurrency involves buying and selling digital assets within a single day to capitalize on short-term price movements. This high-risk strategy requires skill and quick decision-making. Here are five key points about day trading cryptocurrency.

- Market Volatility: Cryptocurrencies are highly volatile, providing opportunities for significant profits but also substantial risks.

- Technical Analysis: Successful day traders rely on technical analysis, using charts and indicators to predict price movements and make informed trades.

- Quick Decisions: Day trading requires fast decision-making and execution, as prices can change rapidly within short timeframes.

- Risk Management: Implement strict risk management strategies, such as setting stop-loss orders and only trading with money you can afford to lose.

- Continuous Monitoring: Stay glued to the market throughout the trading day to react promptly to market changes and news events.

Day trading cryptocurrency can be profitable for skilled traders who thrive in a fast-paced environment, but it requires careful planning and disciplined risk management.

Earn Cryptocurrency Through Airdrops and Bounties

Airdrops and bounties are popular methods to earn cryptocurrency without making a direct investment. They offer opportunities to acquire new tokens and coins, often in exchange for completing simple tasks. Here are six key points to understand about earning crypto through airdrops and bounties.

- Airdrops: These involve receiving free tokens from a project as part of a promotional campaign or to distribute tokens to early supporters.

- Bounties: These are rewards given for completing specific tasks, such as promoting a project on social media, writing articles, or participating in community discussions.

- Eligibility: To participate, you often need to meet certain criteria, such as holding a specific cryptocurrency or completing registration steps.

- Verify Projects: Ensure the legitimacy of the project to avoid scams. Research the project’s background and community feedback.

- Follow Instructions: Carefully follow the instructions provided by the project to qualify for rewards and avoid missing out.

- Track Rewards: Monitor the status of your airdrop or bounty rewards to ensure you receive them as promised.

Airdrops and bounties offer a way to earn cryptocurrency through simple tasks and participation. However, due diligence and careful following of instructions are essential to reap the benefits safely.

Conclusion

Making money with cryptocurrency as a beginner requires patience, research, and a cautious approach. By understanding the basics, choosing the right strategy, and diversifying your investments, you can navigate the volatile crypto market more effectively. Always remember that while the potential for profit is high, so is the risk—so invest only what you can afford to lose.

>> Here’s the Proven Way to Make $100-$200 Daily with 0 Investment – Watch This FREE Video and Start Now >>

Thank you for taking the time to read my article “Cryptocurrency for Beginners: How to Make Money”, hope it helps!