The allure of the stock market as a means of generating wealth is undeniable. However, navigating its complexities can be daunting for beginners. Fortunately, numerous tutorials exist to guide aspiring investors through the process. In this article, we’ll explore seven essential tutorials that offer invaluable insights into making money in the stock market.

>> Here’s the Proven Way to Make $100-$200 Daily with 0 Investment – Watch This FREE Video and Start Now >>

1. Understanding the Basics

Before diving into the world of stock trading, it’s crucial to grasp the fundamentals. Beginners should seek out tutorials that cover essential concepts such as stock market terminology, the role of stock exchanges, and the mechanics of buying and selling stocks. These tutorials provide a solid foundation upon which to build one’s investment knowledge.

2. Developing an Investment Strategy

Successful investing requires a well-defined strategy tailored to your financial goals and risk tolerance. Tutorials on investment strategy delve into various approaches, including value investing, growth investing, and dividend investing. By understanding different strategies, investors can identify the approach that aligns best with their objectives.

3. Conducting Fundamental Analysis

Fundamental analysis is the process of evaluating a company’s financial health and performance to determine its investment potential. Tutorials in this area teach investors how to analyze financial statements, assess company management, and evaluate industry trends. Armed with this knowledge, investors can make informed decisions about which stocks to buy or sell.

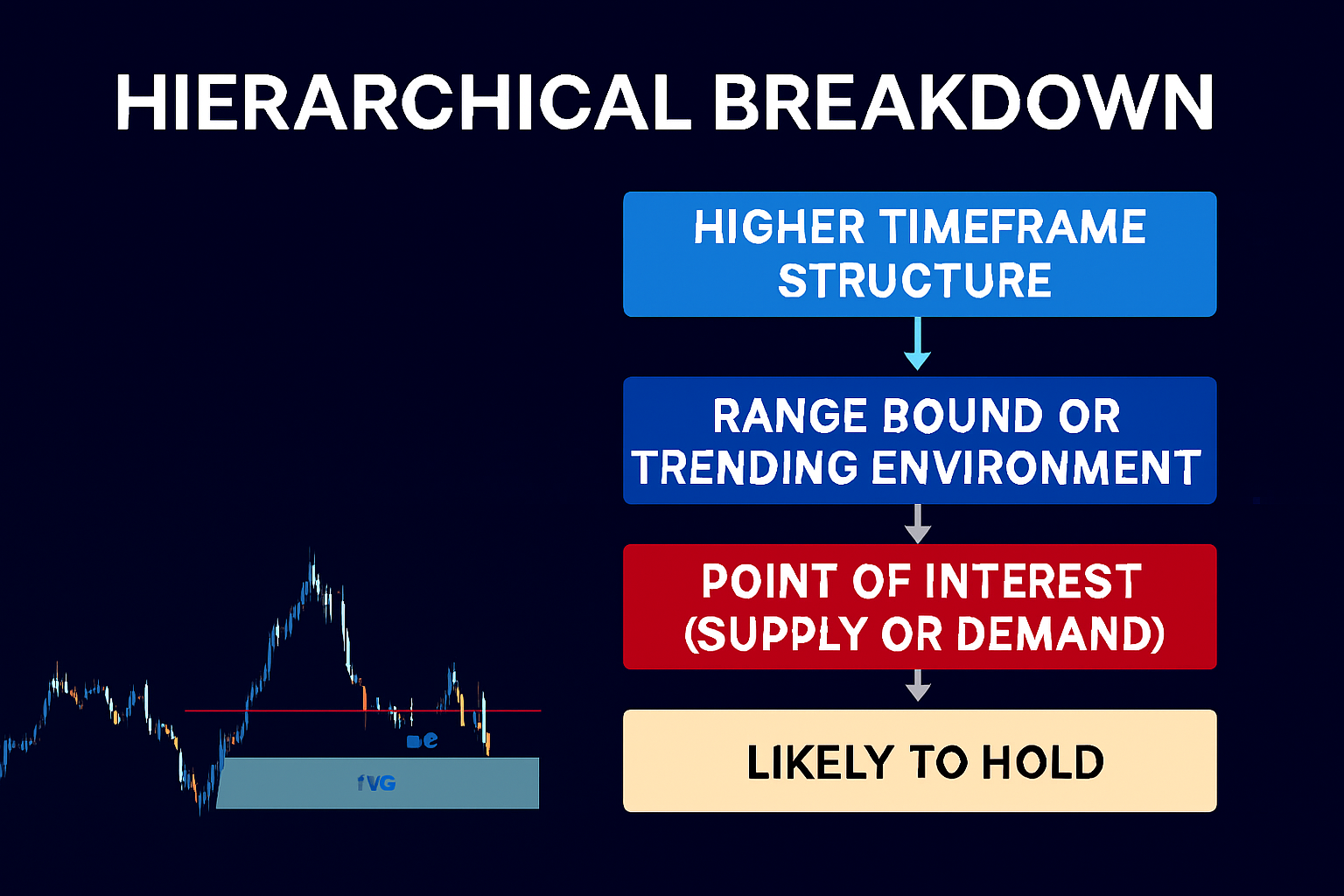

4. Technical Analysis Techniques

Technical analysis involves studying past market data, primarily price and volume, to forecast future price movements. Tutorials on technical analysis introduce investors to chart patterns, indicators, and other analytical tools used to identify trading opportunities. Understanding technical analysis can help investors pinpoint entry and exit points with greater precision.

5. Risk Management Strategies

Investing in the stock market inherently involves risk, but prudent risk management can help mitigate potential losses. Tutorials on risk management cover concepts such as portfolio diversification, position sizing, and setting stop-loss orders. By implementing sound risk management strategies, investors can protect their capital while pursuing returns.

6. Practicing Paper Trading

Paper trading, or simulated trading, allows investors to test their investment strategies without risking real money. Tutorials on paper trading provide guidance on how to use virtual trading platforms to simulate real market conditions. By practicing with paper trading, investors can hone their skills and gain confidence before committing actual capital.

7. Continuous Learning and Adaptation

The stock market is dynamic and constantly evolving, so successful investors must commit to lifelong learning. Tutorials that emphasize continuous education and adaptation are invaluable for staying abreast of market trends, new investment opportunities, and regulatory changes. By remaining curious and open to learning, investors can enhance their chances of long-term success.

>> Here’s the Proven Way to Make $100-$200 Daily with 0 Investment – Watch This FREE Video and Start Now >>

Understanding the Basics

Embarking on your journey into the stock market can be overwhelming, but mastering the basics is the first step towards success. Understanding fundamental concepts lays a strong foundation for your investment endeavors.

- What is the Stock Market? The stock market is a platform where investors buy and sell shares of publicly traded companies. It serves as a marketplace for capital allocation and wealth creation.

- Stock Market Participants Key players in the stock market include individual investors, institutional investors, traders, and companies issuing stocks.

- Stock Market Indices Indices like the S&P 500 and Dow Jones Industrial Average track the performance of groups of stocks, providing insights into overall market trends.

- Types of Stocks Common stocks represent ownership in a company and offer potential for capital appreciation and dividends, while preferred stocks typically offer fixed dividends.

- Market Order vs. Limit Order A market order executes at the prevailing market price, while a limit order specifies a price at which you’re willing to buy or sell a stock.

- Bull vs. Bear Markets Bull markets are characterized by rising stock prices and investor optimism, whereas bear markets see declining prices and pessimism.

- Investment Risks All investments carry risk, including the potential for loss of capital. Understanding and managing risks is essential for long-term success.

Mastering the basics of the stock market sets the stage for informed decision-making and successful investing. By grasping concepts like market structure, order types, and risk management, beginners can navigate the stock market with confidence.

Developing an Investment Strategy

Building a solid investment strategy is crucial for success in the stock market. By outlining your goals and risk tolerance, you can develop a plan tailored to your needs.

- Define Your Objectives Clarify your financial goals, whether it’s wealth accumulation, retirement planning, or funding other life milestones.

- Assess Your Risk Tolerance Understand your willingness and ability to tolerate risk, considering factors like age, income, and investment timeline.

- Choose Your Investment Approach Explore different strategies such as value investing, growth investing, or dividend investing, aligning them with your objectives and risk profile.

- Asset Allocation Diversify your portfolio across asset classes like stocks, bonds, and real estate to spread risk and optimize returns.

- Time Horizon Consider your investment timeline when selecting assets and adjusting your strategy over time.

- Regular Review and Rebalancing Monitor your portfolio periodically and rebalance as needed to maintain alignment with your investment strategy.

- Stay Disciplined Stick to your plan through market fluctuations and avoid impulsive decisions driven by emotion.

Crafting an investment strategy tailored to your goals and risk tolerance lays the groundwork for long-term financial success. By following a disciplined approach and periodically reassessing your strategy, you can navigate the complexities of the stock market with confidence.

Conducting Fundamental Analysis

Fundamental analysis is a vital tool for investors seeking to make informed decisions in the stock market. By evaluating a company’s financial health and performance, investors can gauge its investment potential.

- Understanding Financial Statements Learn to interpret balance sheets, income statements, and cash flow statements to assess a company’s financial position.

- Evaluating Business Models Examine the company’s industry, competitive positioning, and growth prospects to understand its long-term viability.

- Assessing Management Quality Evaluate the leadership team’s track record, strategic vision, and corporate governance practices.

- Analyzing Growth Potential Look for signs of revenue growth, expanding profit margins, and innovative product offerings.

- Examining Valuation Metrics Consider valuation ratios such as price-to-earnings ratio (P/E), price-to-book ratio (P/B), and dividend yield to assess the stock’s attractiveness.

- Reviewing Economic Indicators Monitor macroeconomic factors like interest rates, inflation, and consumer confidence to gauge the broader market environment.

- Incorporating Qualitative Factors Consider qualitative factors like industry trends, regulatory environment, and geopolitical risks in your analysis.

By mastering fundamental analysis techniques, investors can make well-informed decisions and navigate the stock market with confidence. Understanding a company’s financial health, growth potential, and broader market dynamics is essential for long-term investment success.

>> Here’s the Proven Way to Make $100-$200 Daily with 0 Investment – Watch This FREE Video and Start Now >>

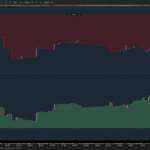

Technical Analysis Techniques

Technical analysis empowers traders to forecast future price movements by analyzing historical market data. Understanding key techniques can enhance trading decisions and timing.

- Chart Patterns Identify patterns like head and shoulders, triangles, and flags to anticipate potential price reversals or continuations.

- Indicators and Oscillators Utilize tools such as moving averages, Relative Strength Index (RSI), and MACD to identify overbought or oversold conditions and trend strength.

- Support and Resistance Levels Identify price levels where buying or selling pressure historically increases, guiding entry and exit points.

- Volume Analysis Analyze trading volume to confirm price trends and detect potential reversals.

- Trendlines Draw trendlines to visualize price trends and identify potential breakout or breakdown points.

- Candlestick Patterns Interpret candlestick formations to assess market sentiment and predict price movements.

Technical analysis equips traders with valuable tools to analyze market dynamics and make informed trading decisions. By mastering chart patterns, indicators, and other techniques, traders can navigate the stock market with precision and confidence.

Risk Management Strategies

In the unpredictable world of investing, safeguarding your capital is paramount. Effective risk management strategies are the cornerstone of a successful investment approach, ensuring you can weather market volatility and protect your financial assets.

- Diversification: Spread your investments across different asset classes, industries, and geographic regions to mitigate the impact of any single event.

- Position Sizing: Limit the size of each investment to a percentage of your total portfolio, reducing exposure to any one position.

- Stop-Loss Orders: Set predetermined price points at which you’ll sell a security to limit potential losses.

- Hedging: Use options, futures, or other derivatives to offset potential losses in your portfolio.

- Asset Allocation: Regularly rebalance your portfolio to maintain your desired mix of assets and risk exposure.

- Emergency Fund: Maintain a cash reserve to cover unexpected expenses or market downturns without liquidating investments.

- Risk Assessment: Regularly assess your risk tolerance and adjust your investment strategy accordingly.

- Continuous Learning: Stay informed about market trends and economic indicators to anticipate and manage potential risks effectively.

Using these risk management strategies, investors can protect their capital and navigate the uncertainties of the market with confidence. Remember, mitigating risk is key to achieving long-term financial success.

Practicing Paper Trading

Paper trading, also known as simulated trading, offers a risk-free environment for investors to practice trading strategies and hone their skills. This invaluable tool allows beginners to gain experience without risking real capital.

- Choosing a Platform Select a paper trading platform that simulates real market conditions and offers a wide range of financial instruments.

- Setting Goals Establish clear objectives for your paper trading experience, such as learning a specific strategy or mastering a trading platform.

- Implementing Strategies Experiment with different trading strategies, from day trading to swing trading, and observe their impact on your virtual portfolio.

- Emphasizing Discipline Treat paper trading as seriously as you would live trading, adhering to predetermined rules and risk management principles.

- Analyzing Performance Evaluate your trades and performance metrics to identify strengths, weaknesses, and areas for improvement.

- Learning from Mistakes Use paper trading as a learning opportunity to refine your approach and avoid costly mistakes in real-world trading.

- Transitioning to Live Trading Once confident in your abilities, consider transitioning to live trading with a small amount of capital, applying lessons learned from paper trading.

Paper trading serves as a valuable training ground for aspiring traders, allowing them to gain experience and confidence before risking real money in the stock market. By leveraging simulated trading platforms effectively, beginners can accelerate their learning curve and improve their chances of success in live trading.

Continuous Learning and Adaptation

In the dynamic landscape of the stock market, staying ahead requires a commitment to continuous learning. Embracing new ideas and adapting to changing market conditions is essential for long-term success.

- Stay Informed: Keep abreast of market trends, economic news, and regulatory changes through reputable sources like financial news websites and market analysis reports.

- Learn from Experience: Reflect on your past investment decisions, both successes and failures, to glean valuable lessons for future endeavors.

- Explore New Strategies: Be open to exploring different investment strategies and techniques, such as value investing, growth investing, or technical analysis.

- Leverage Educational Resources: Take advantage of books, online courses, and seminars to deepen your understanding of investment principles and market dynamics.

- Network with Peers: Engage with other investors, join online forums, or attend investment clubs to exchange ideas and perspectives.

- Adapt to Market Conditions: Recognize when market conditions shift and be willing to adjust your investment approach accordingly.

- Evolve with Technology: Stay updated on technological advancements in trading platforms, data analytics, and algorithmic trading to enhance your investment capabilities.

By embracing continuous learning and adaptation, investors can navigate the ever-changing landscape of the stock market with confidence and agility. Remember, the willingness to learn and evolve is key to thriving in an increasingly competitive environment.

Conclusion

Navigating the stock market can be challenging, but with the right guidance, investors can increase their chances of success. By availing themselves of tutorials that cover essential topics such as investment fundamentals, strategy development, and risk management, aspiring investors can embark on their journey with confidence. Remember, investing is a journey, not a destination, so commit to continuous learning and adaptation to thrive in the dynamic world of the stock market.

>> Here’s the Proven Way to Make $100-$200 Daily with 0 Investment – Watch This FREE Video and Start Now >>

Thank you for taking the time to read my article “Tutorials on How to Make Money in the Stock Market”, hope it helps!